How to set rent prices for student accommodation

Image courtesy of Adobe

Setting the right rent price for student accommodation is essential if you want to maximise occupancy, minimise voids, and increase profitability.

It’s not always easy to figure out how much rent you should be charging, as supply and demand within the student accommodation market varies so much, both year-on-year and between different locations.

We’re breaking down everything you need to know about how to set rent prices for student accommodation, including the average price of student accommodation in the UK, and key factors to consider when rate setting.

What is the average price of student accommodation in the UK?

The price of student accommodation will vary significantly depending on factors such as location, accommodation type, and the facilities available in the property. If you choose to offer your properties with bills included, your base rental price will also be higher.

In general, purpose-built student accommodation (PBSA) is more expensive than HMOs. Currently, according to StuRents data, the average price of an HMO in the UK is £132 per person, per week (pppw), while the average price of PBSA is £187 pppw.

5 factors that impact how to set the rent price of student accommodation

Setting the rent price for your student accommodation is a balancing act. Pricing too low can limit your profitability while overpricing can reduce the appeal of your property, lead to longer void periods, and contribute to low tenant retention rates.

When thinking about how to set the rent price for your student accommodation, you need to identify and analyse several factors that contribute to your property’s value. This will allow you to set a fair rental price.

These are the five key factors you should consider when setting rent prices.

1. Local market

When pricing student accommodation, it is essential that you research what other competitors in the area are charging. To price accurately and competitively, you need to understand tenant demand in your local area and the average prices in the market.

If the current draft of the Renters’ Rights Bill passes into law, tenants will be able to challenge rent increases that are considered to be above market rates in the First Tier Tribunal, making it even more important that you understand your local market.

StuRents produces Quarterly Reports for 46 university towns and cities across the UK and Ireland, as well as a National Report. You can download our reports to gain insights into key factors that inform rent setting such as local supply and demand, student search behaviour, and average search budgets.

2. Location and neighbourhood

The location of your property will affect the rent you can charge. If your student accommodation is in a desirable neighbourhood or has a convenient location close to university campuses, then you should be able to charge a higher rental price as there will be more demand from prospective tenants.

Your property will also be more attractive if it is close to public transport links and other local amenities that students value (such as supermarkets, hospitality venues, and the city centre).

3. Property type

The type of property you’re renting will affect the amount of rent you can charge for it, along with its size and physical attributes. As mentioned before, the average rent for a room in an HMO will be lower than in PBSA. Even within PBSA, larger studio rooms tend to be more expensive than other rooms in shared flats. In general, the bigger the property and living space, the higher the rental price you can charge.

4. Property condition

Accurately assessing the condition of your property is very important when setting the rental price. If the property is modern, newly renovated, and very well maintained, then you can charge a higher rental price. If you notice wear and tear after tenants have moved out, consider repainting or refurbishing where necessary.

5. Features, furnishings and amenities

Any additional features or unique selling points your property has could add value to your student accommodation and allow you to set a higher rental price. For example, specific features of your property that could be appealing include disabled access, outdoor space, parking or bike storage.

Many PBSA buildings also have amenities such as private gyms, cinemas, and study areas that can be very attractive to students.

How to calculate the rental yield for your student property

Rental yield helps you to assess the return on investment (ROI) you are getting from your student properties. To work out your rental yield, you should divide the annual rent you are collecting by the property’s value and multiply this figure by 100. This will give you your rental yield as a percentage.

- Rental yield = annual rent/property value x 100

The higher the rental yield, the more return on investment you are getting. For reference, a rental yield of around 5-7% is considered good, with anything above 7% being considered very good.

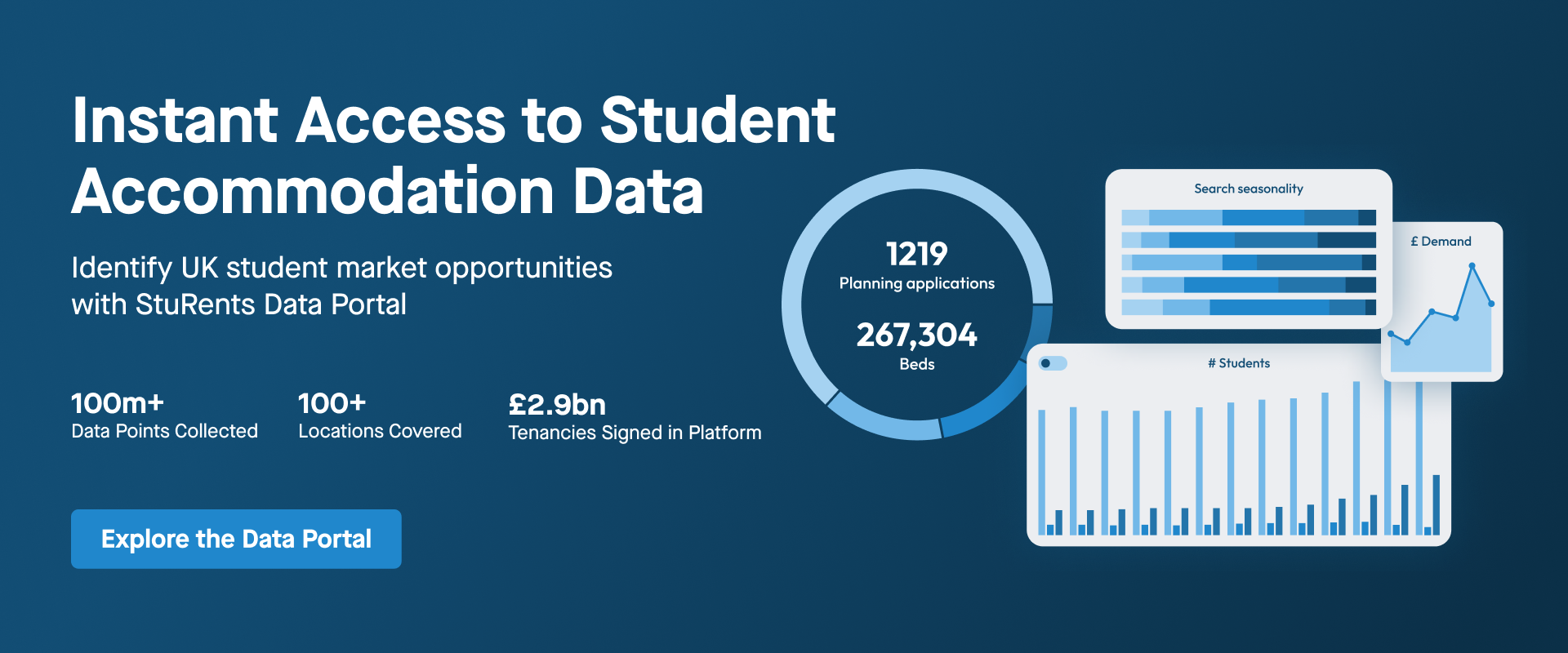

Assess market trends and inform your pricing strategies with StuRents

Want to perfect your student accommodation pricing and marketing strategies? Download our free report to gain insights into supply distribution, average pricing per accommodation, student search budgets and behaviours, and seasonal demand trends.

Share