StuRents' Q3 Webinar: Q&A roundup and sector sentiment

Image courtesy of Flickr

We recently hosted our Q3-2025 webinar, presenting the latest trends and insights from the sector alongside a guest presentation from Loc8me founder Raffaele Russo. Here, we answer some of the questions we received and have a look at sector sentiment through attendee poll answers.

Webinar Questions & Answers

Note: questions edited for clarity.

Q: We’re hearing a lot about a number of markets being late this year, and that students are more savvy about pricing and deals. How might this be impacting weekly rents and net operating income (NOI)?

As we’ve seen with the occupancy data, the jury is still out as to whether the market is truly lower this year. Either way, the cost of acquisition could be better understood and more accurately reflected when assets are being valued.

Headline rents are up year-on-year, as is total contract value, although these have fallen from the highs reported a few years ago. Incentives have become more popular and widely used which, alongside agent fees and other costs, may reduce net rents and lower NOI.

Q: Despite the eye-catching headlines, are we really seeing a reduction in Chinese and overseas students in Russell Group Universities?

UCAS data is still showing strong growth from Chinese students, with a surge of acceptances this year. The unknown at this stage is postgraduate recruitment, with the latest OfS data indicating significant declines. The most recent HESA data has shown an overall decline in Chinese postgraduates since the 2021-22 academic year, so it’s still unknown how this trend is developing in the recent academic year.

Q: If there is such a shortage of PBSA beds when looking nationally, why are the operators not finding it easier to lease their beds?

As discussed, a national view of supply vs demand obscures city-level insights, as do student-bed-ratios at a city-level. Some locations will need an increase in supply to meet expected demand, while others do not.

Product fit is also key, so that existing and future supply in a market is matched to student budgets and preferences. For example, if there is a growing demand for accommodation at ~£150pppw, and new supply is priced at over £200pppw, this will not be able to alleviate pressures despite a headline increase in supply.

It’s also worth noting that relatively few students overall can afford the cost of new-build PBSA, often priced well in excess of £200pppw.

Q: How might the Nottingham market play out over the course of the next 12-24 months?

The market is certainly slower than in previous years, although we have yet to see the difficulties that cities such as Coventry and Sheffield have historically faced. Considering a more realistic addressable market and ~40% of pipeline beds delivered, even a high demand growth of 4-6% per annum could see the market oversupplied for several years.

Positively, Nottingham University has moved up the QS World University Rankings to sit in the top 100, which could increase desirability and bolster demand in the coming years.

Q: How could institutional capital entering the HMO space change the landscape, particularly around property prices carrying a premium due to the difficulty for smaller landlords entering the market?

Student HMOs already carry a premium to the Private Rented Sector (PRS). Institutional capital and increased interest in the sector should ultimately improve liquidity, benefitting new and existing entrants. Those with scale should hypothetically be able to capitalise on economies of scale in the HMO space through efficient systems and could provide more desirable products for students.

For smaller landlords, increased regulation is likely to remain a significant barrier to entry.

Q: If a property is let to students under a licence with each student having a licence, how will the Renters’ Right Bill (RRB) - once it’s live - apply over the terms of the licence?

The current understanding is that the RRB will not apply to licence agreements. The rights and limitations of licences need to be understood by all parties, such as tenants, not having exclusive possession. The use of licences to circumvent the RRB could be looked upon poorly by local authorities.

Q: After the Renters’ Right Bill comes into effect, how might the 6-month limit on signing tenancies in advance affect HMO lettings cycles? Could this be a good thing?

Landlords will still be able to agree tenancies more than 6 months in advance, however they will lose grounds 4A possession if they do so, which provides an incentive to stick within the requirements. Whether landlords will take a proactive approach or wait until the RRB comes into force before any changes to lettings seasonality is yet to be seen.

To provide an alternative view, rents could be driven up by more students searching within the same periods due to restrictions imposed by the RRB.

Sector sentiment and attendee poll

Note: analysis based on approximately 100 responses for each question.

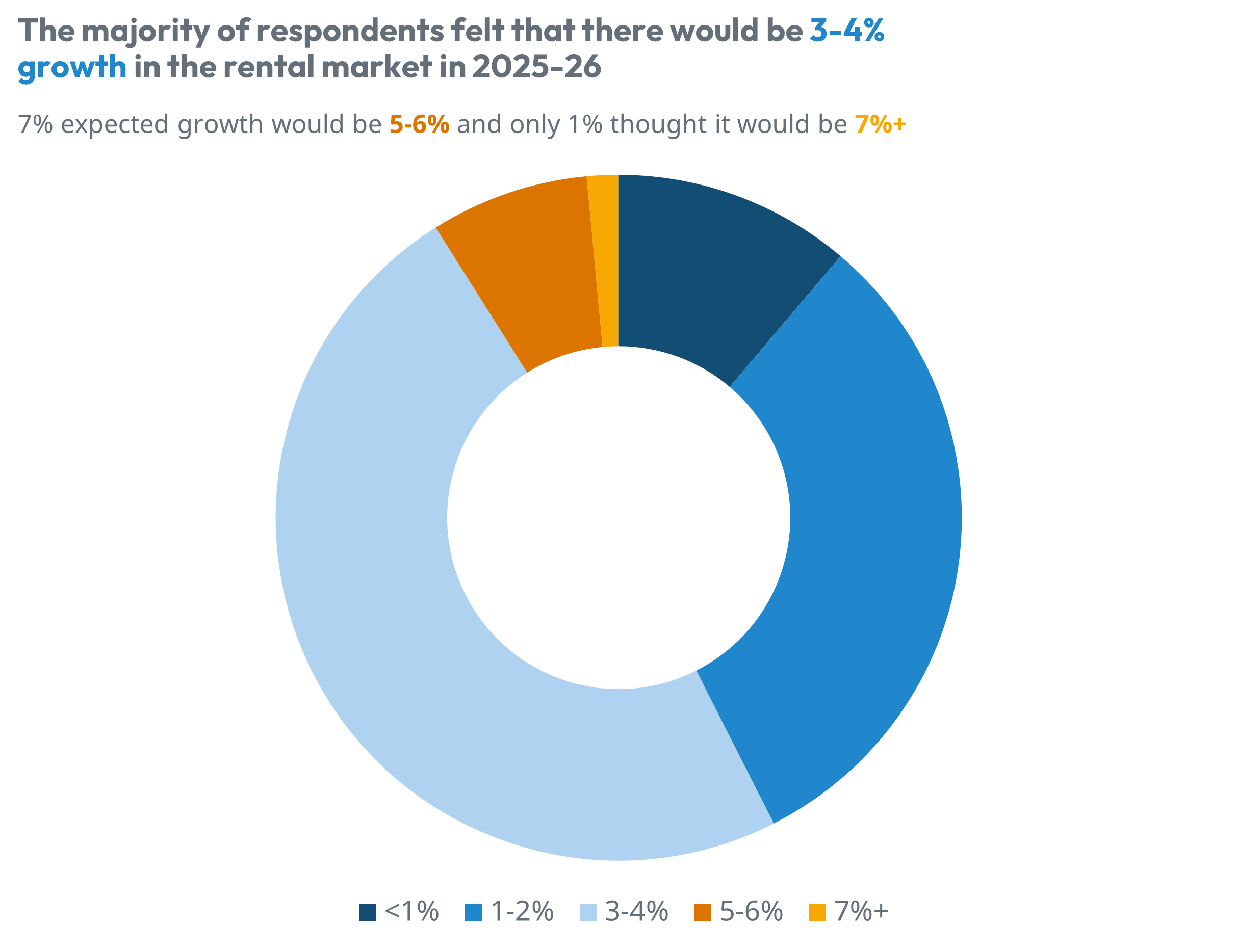

The first question for attendees was their current expectation for rental growth in the 2025-26 academic year. Around half of the respondents believed there would be 3-4% growth, with 31% taking a more reserved view at 1-2% growth. While around 11% of people were anticipating little or no growth, only 1% were very optimistic with growth expectations of 7% or above. While there is some optimism in the responses, the general outlook is more conservative - reflective of wider trends we’re seeing nationally.

Chart 1: Split of responses for rental market growth in 2025-2026

Source: StuRents' Quarterly Webinar

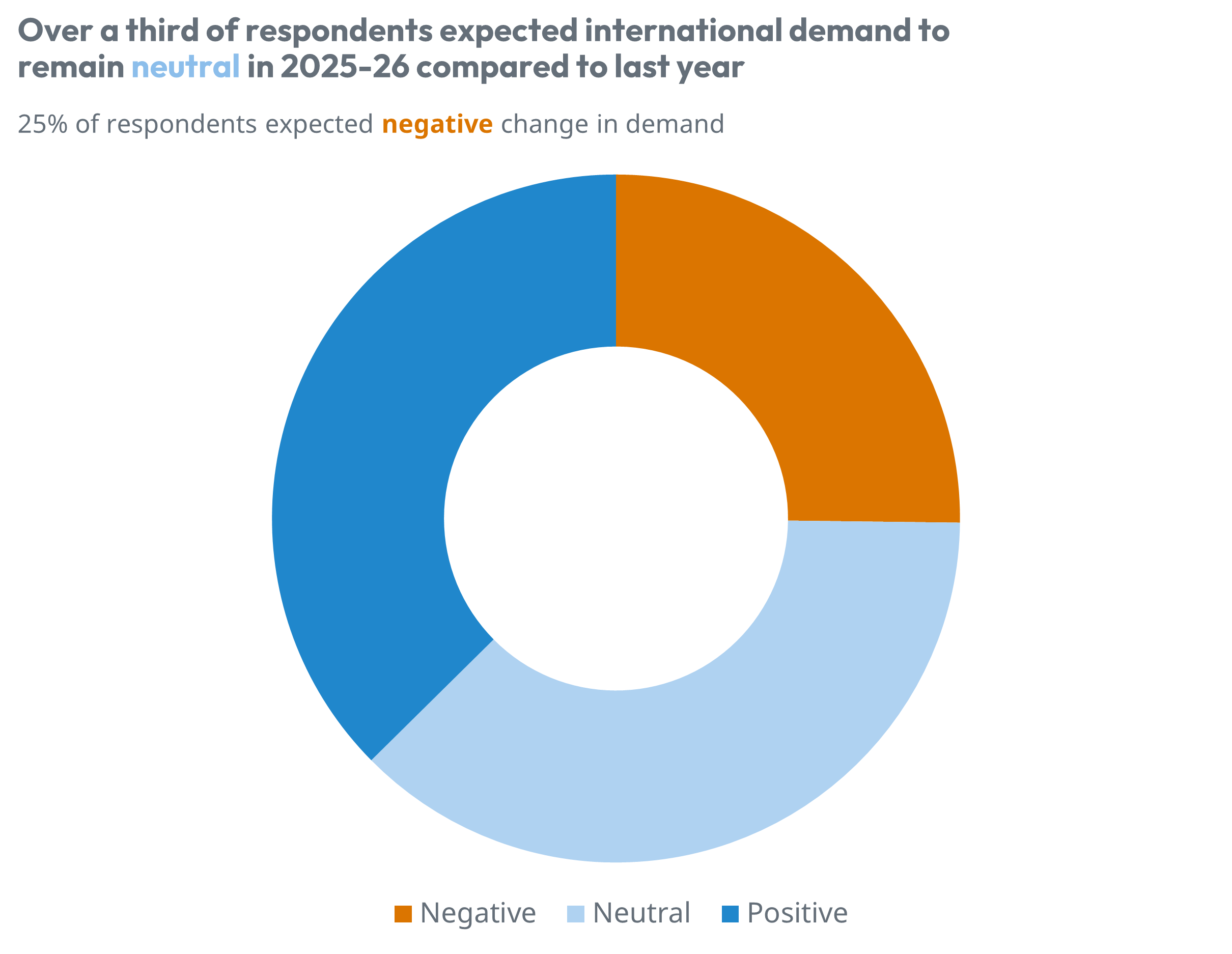

Moving to the topic of international students, we asked attendees about their expectations for overseas demand compared to last year. Both neutral outlook (i.e. little or no change) and positive change received 37% of votes, with 25% indicating a negative stance. While there is volatility in international student numbers, the UCAS clearing data is showing strong growth from China still; although postgraduate student numbers are still a big unknown.

Chart 2: Split of responses for international student demand in 2025-2026

Source: StuRents' Quarterly Webinar

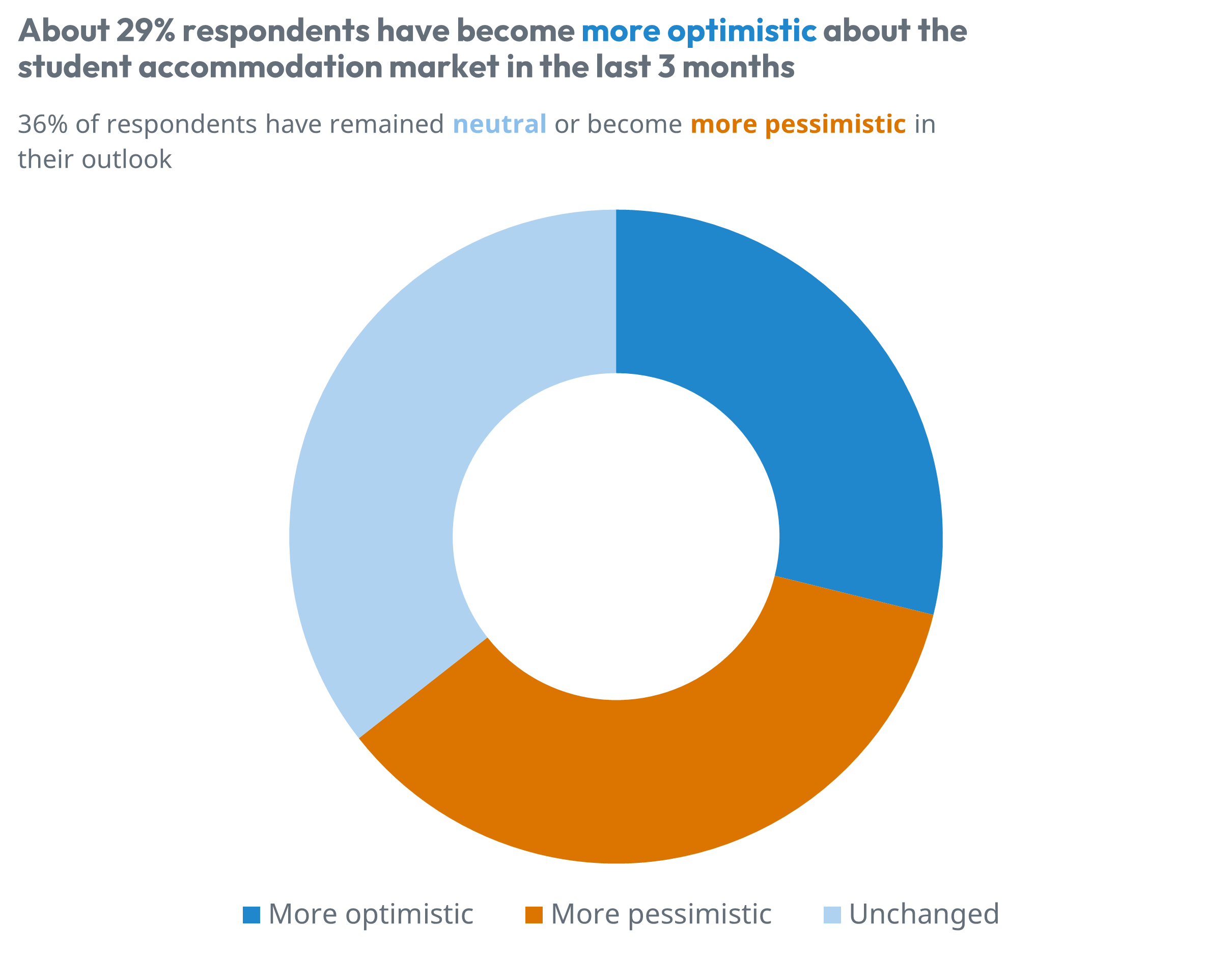

Finally, we asked webinar attendees how their view of the student accommodation market more generally has shifted in the last quarter. While 29% of respondents have become more optimistic, neutral or pessimistic responses each collected 36% of votes. Our occupancy survey and rent tracking show that while it’s been a difficult year across markets, there is positive momentum gathering in recent months.

Chart 3: Split of responses for student accommodation market outlook in 2025-2026

Source: StuRents' Quarterly Webinar

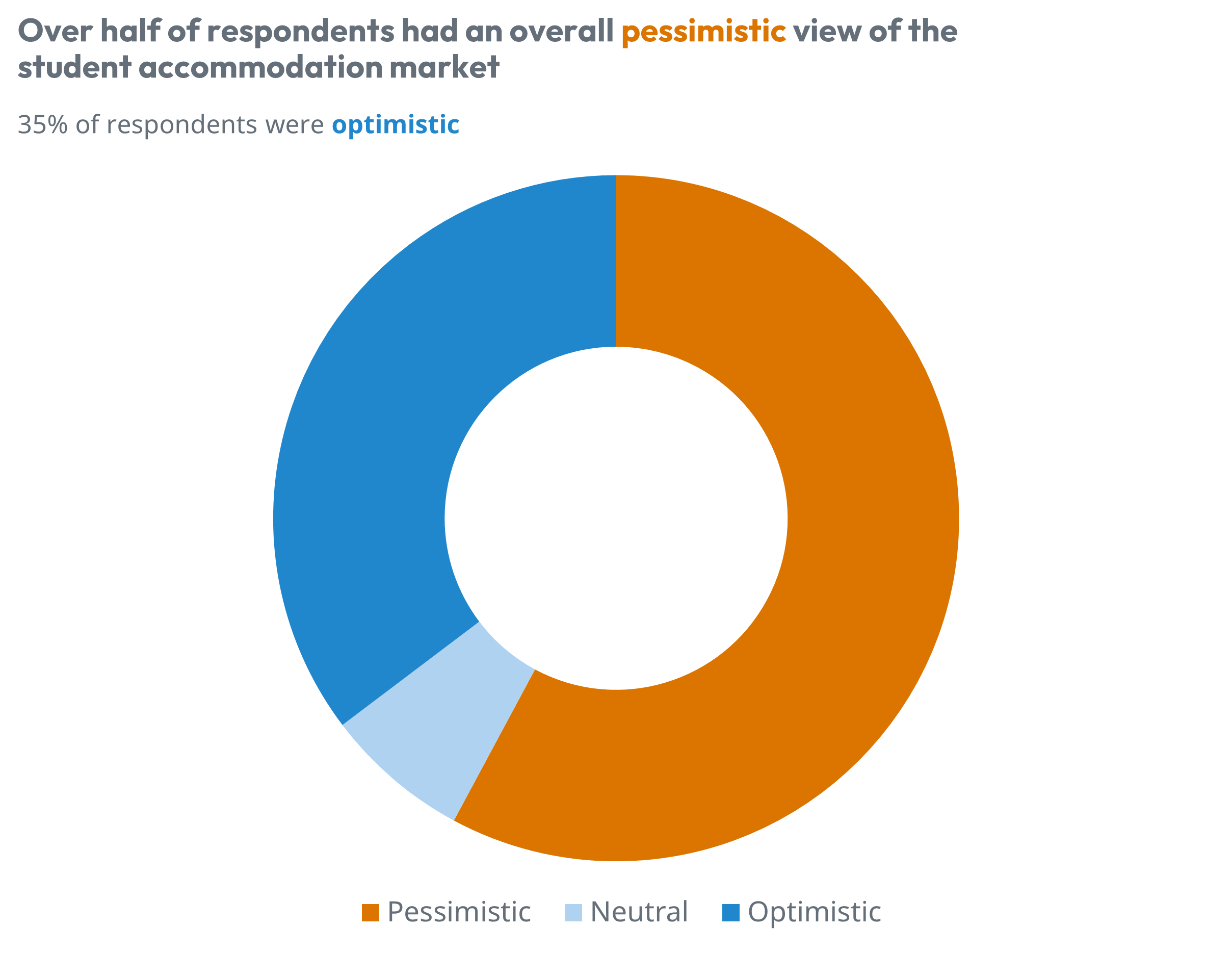

Combining responses into an aggregated view (by assigning numerical values to optimistic, neutral and pessimistic responses), there was a pessimistic sentiment to the student accommodation market overall, with around 58% of respondents indicating negative or pessimistic sentiment across all three questions. While data indicates that planning activity and investment has been slowing, and many markets continue to lease slower compared to previous years, some markets are still facing a real shortage in student beds. The right kind of data is critical in identifying these city or intra-city locations and capitalising on the opportunities early.

Chart 4: Split of sentiment for student market outlook in 2025-2026

Source: StuRents' Quarterly Webinar

For more information about our proprietary, highly granular data covering UK student accommodation contact the StuRents Research team today. Book a demo of our Data Portal to find out how you can have up-to-the-minute university housing insights at your fingertips, or get in touch with us about our Occupancy Survey.

Share