Annual Student Accommodation Report 2025

Singapore - 2025 UK Student Accommodation Insights Breakfast

In early November, I had the pleasure of presenting a detailed overview of the UK student accommodation market to institutional capital based in Asia, highlighting some of the data from our upcoming 2025 UK Student Accommodation Report.

Our inaugural Singapore breakfast seminar also gave stakeholders in the region the opportunity to hear first-hand from a range of industry experts, including Allsop and Russell Charles Speechlys.

The data-led presentations focused on three key areas, including:

- The latest market drivers determining PBSA leasing velocity, as well as future market opportunities and risks

- Updates from the capital markets, including insights into the latest transactions

- An overview of the legislative environment, including the Building Safety Act and the potential outcomes from the Renters’ Rights Act

We have an existing calendar of events planned for 2026 and will also be attending MIPIM in March. Do reach out if you would like to be involved in our planned events.

2025 UK Student Accommodation Report Key Trends

Demand trends driving PBSA occupancy and rents

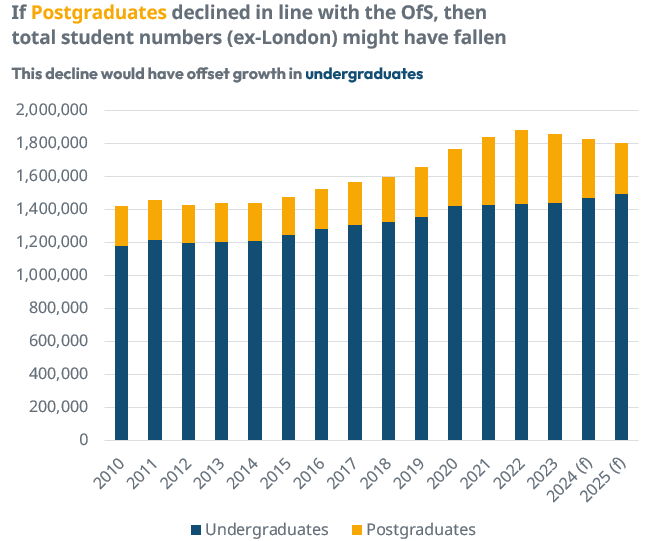

Recruitment volatility has shaped the market for the last few years, with estimated declines in postgraduates likely to have dragged down total student numbers. This is against a backdrop of continued growth in undergraduate demand, although anecdotal evidence also suggests this increase has been offset by a rising number of British students deciding to live at home.

As a result of these shifting demand trends, we estimate that the total number of students outside of London has likely fallen for three consecutive years, as highlighted below.

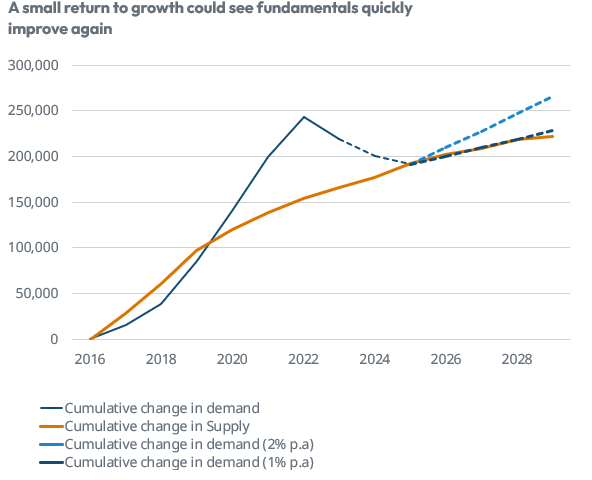

Using this analysis and comparing changes to demand for accommodation versus changes to supply, it becomes apparent that the spread between cumulative demand and supply growth has materially narrowed.

While these fundamentals will vary significantly per location, at a national level, this narrowing in the spread correlates to a slower leasing environment and lower rental growth. Equally, when the spread was at its widest, the sector reported double-digit rental growth and very strong occupancy.

Affordability challenges

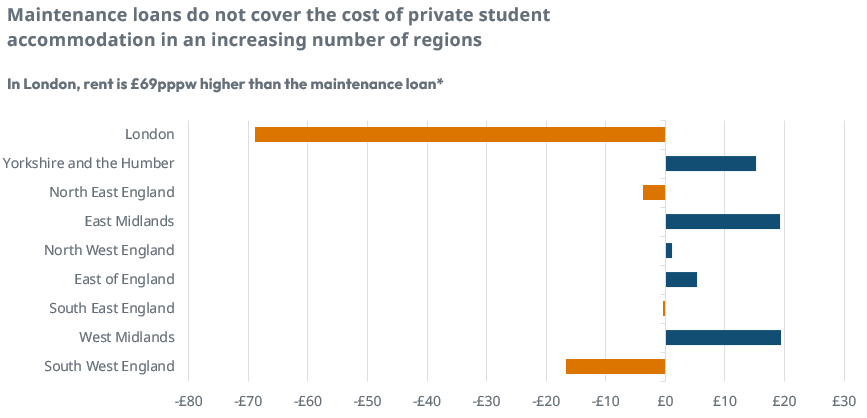

While many sector commentators refer to the maximum maintenance loan when discussing affordability challenges, in reality, only a small proportion will receive this. A prospective student coming from a family with one working parent earning just above the minimum wage will not be entitled to the full loan, highlighting the impact of the means-tested approach.

Adjusting the maintenance loan to account for a student coming from a family with a total income of £40k p.a., the challenges that face students are clearer. There are now four regions of the UK where, on this basis, the loan does not even cost the average cost of accommodation, which will create a negative drag on domestic demand growth.

PBSA leasing velocity

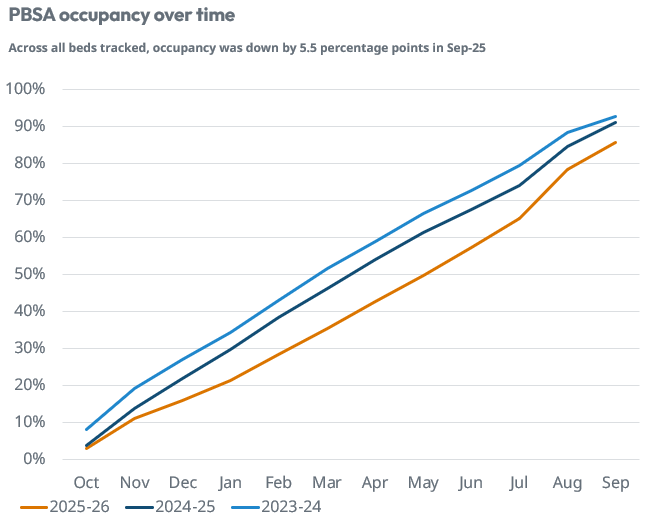

With changing market dynamics, the leasing velocity of PBSA has been both slower and lower in the most recent cycle. Underpinning this is a change in the booking behaviour of students, with an increasing number deciding to secure their accommodation later in the cycle, perhaps in an attempt to benefit from incentives, which have risen in popularity in the last few years.

As of September, aggregated across all the markets we track, PBSA occupancy was reported at 86%, down from 91% reported during the same period a year earlier.

Renters’ Rights Act and its possible impact

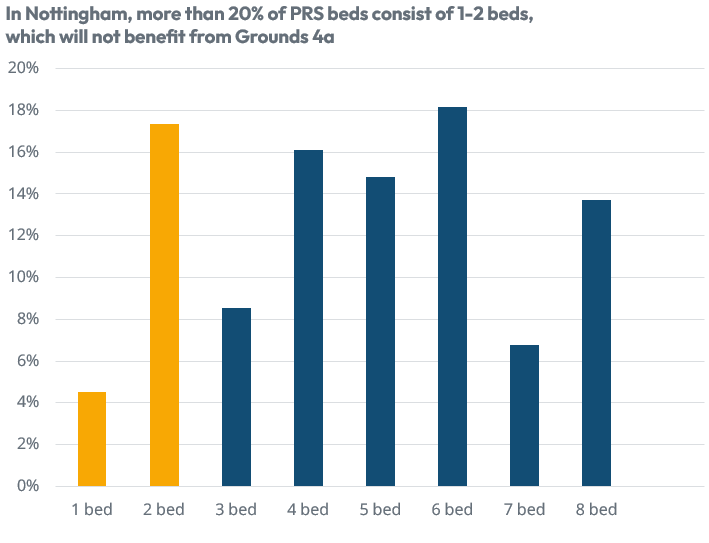

Elsewhere, the Renters’ Rights Act is the biggest shakeup in over a decade and while the exact ramifications on supply and how HMO landlords will react are unclear, such measures could benefit the PBSA sector over the medium term. One and two-bedroom properties, which can make up a notable proportion of supply in some locations, will have no certainty over tenure, while a greater legislative burden could lead to a tightening of supply. Such reductions could ultimately lead to higher HMO rents, with a positive knock-on effect for more affordable PBSA.

Sector Outlook

With the supply vs demand gap narrowing, the outlook for future performance will hinge on a return to demand growth. Positively, an increase in demand of ~1-2% will be enough to offset future supply growth, although in some locations this requirement will be significantly higher.

Last year, we posited that the market won't be smooth sailing for all and therefore, a detailed understanding of product, demand, and total supply will remain of critical importance. If anything, the last 12 months have only strengthened this view, highlighting the risks but also opportunities which can be identified through quality independent data.

These insights have been derived from our 2025 UK Student Accommodation Report.

To access the report in full, click here

Share