StuRents' Annual Webinar 2025: Q&A and poll results

We recently hosted our 2025 Annual Webinar, where we explored the student accommodation trends and insights from the past year and shared our outlook on what lies ahead for the sector. We were joined by Allsop’s Anthony Hart, Landmark Properties’ Ioannis Verdelis and Maslow Capital’s Sky Mapson, who shared their perspectives on a range of topics. Here, we answer some of the questions we received and have a look at sector sentiment through attendee poll answers.

If you missed the webinar, you can request access to the full recording here.

Webinar Questions & Answers

Note: questions edited for clarity.

What trends have you observed regarding average tenancy length?

Generally speaking, average PBSA contract length has been coming down in recent years. Considering demographic mix, there is a clear distinction between the average tenancy length within PBSA being agreed by British students versus Chinese students, with the former typically preferring shorter agreements. On a locational basis, we’ve observed a strong link between occupancy performance and tenancy length. Where occupancy has softened, operators are shortening contracts to stimulate demand, while high-performing cities continue to maintain longer contract structures.

Given the high cashbacks and rent reductions offered in the last cycle, what impact do you anticipate this will have on the 26-27 cycle? Any recommendations on how we can best manage these effects moving forward?

For those struggling markets where cashbacks and offers were used late on to encourage leasing, a readjustment may be necessary. If pricing is set realistically at launch, the need for heavy incentives should ease. The key for operators is to monitor booking velocity closely and use discounts tactically rather than as a blanket strategy.

Are students simply becoming more price sensitive, as the general UK population is too? Is the economic climate driving students to make decisions such as staying at home or choosing HMOs over PBSA?

While price sensitivity among students is of course closely aligned to the same economic pressures felt by the general UK population, how this is effecting student behaviour is not known for sure. As student number data from HESA is still only up to 2023, any official available live-at-home rate will be out of date.

However, the affordability issue is clear. Based on a combined family household income of just £40,000, outside of London a student would be eligible for a maintenance loan of £8,285. Taking into account the average blended cost of private accommodation across both PBSA and HMOs, students can expect to have less than £5 per week remaining. This represents a significant deterioration compared to the £27 per week reported in 2021. In London, rent is £69pppw higher than the maintenance loan.

British students have always overwhelmingly chosen HMOs over PBSA. Executed contract data from StuRents’ property management software, Concurrent, shows that most British tenancies are being signed in the HMO market, with ~25% deciding to live in PBSA.

Changes in student behaviour has been observed though, with data from StuRents’ Occupancy Survey showing that students were booking later in the cycle for 2025-26. This could indicate that students are becoming more price-savvy, willing to wait later so they can maximise any available incentives and cashbacks.

What do you see as the ideal way to cater for the increasing demand for affordable accommodation? For example making more non-ensuite clusters available, ‘twodios’ and ‘threedios’ rather than studios, or having more limited on-site amenities?

Sky–high construction costs, prolonged planning processes and barriers to entry caused by increased regulations has made building affordable stock difficult in recent years, regardless of the configuration of any proposed site. One solution to this could be turning to regenerating older buildings instead, reducing costs involved and barriers to creating affordable accommodation.

We explore the topics raised here and many more in our recently released Annual Student Accommodation Report, request free access here.

Sector sentiment and attendee poll

Note: analysis based on approximately 160 responses for each question.

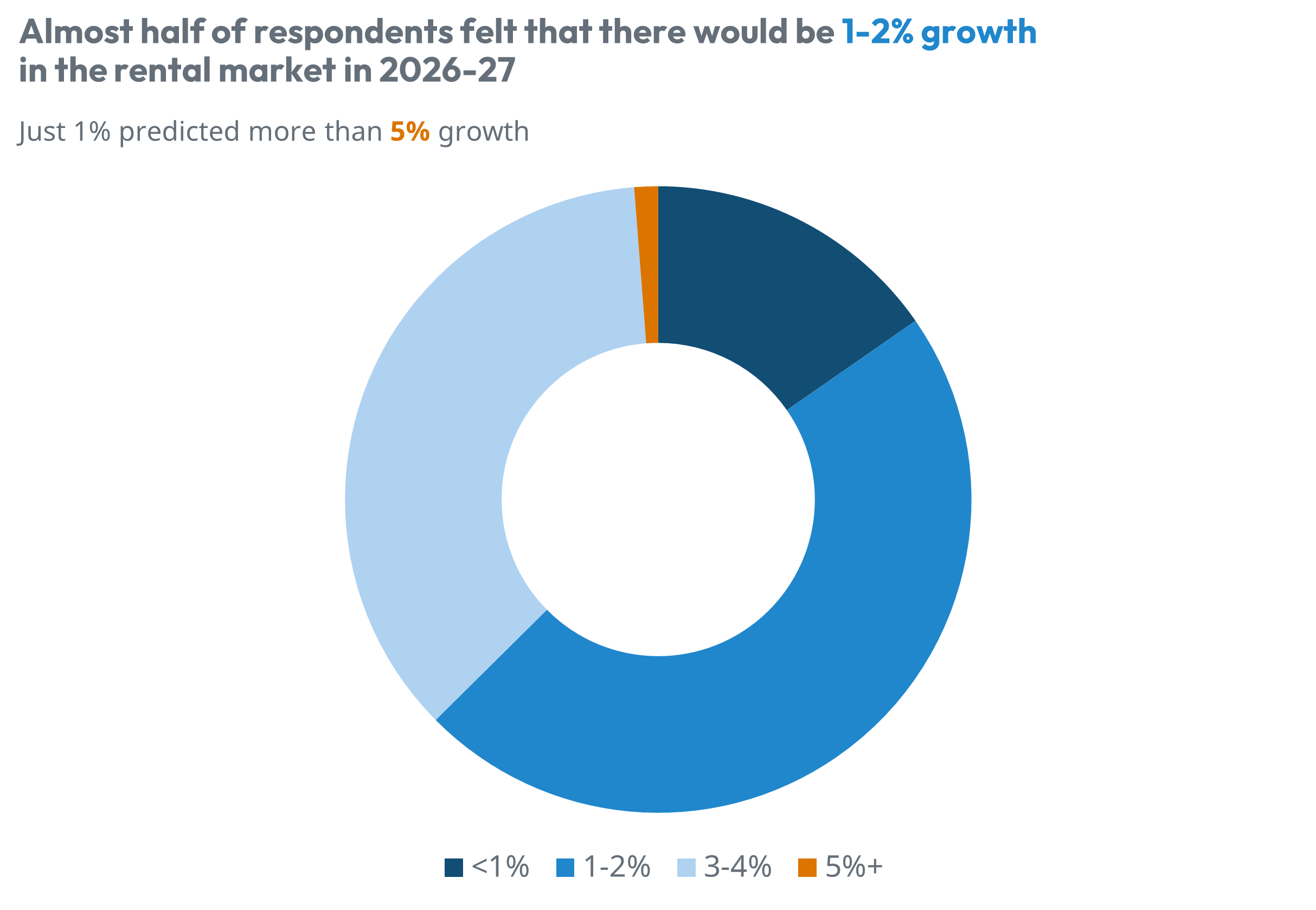

The first question for attendees was their current expectation for rental growth in the 2026-27 academic year. Nearly half of the respondents believed there would be 1-2% growth, with 15% taking a more reserved view at <1% growth. While around 36% of people were anticipating growth of 3-4%, only 1% were very optimistic with growth expectations of 5% or above. While there is some optimism in the responses, the general outlook is more conservative - reflective of wider trends we’re seeing nationally.

Source: StuRents' Annual Webinar

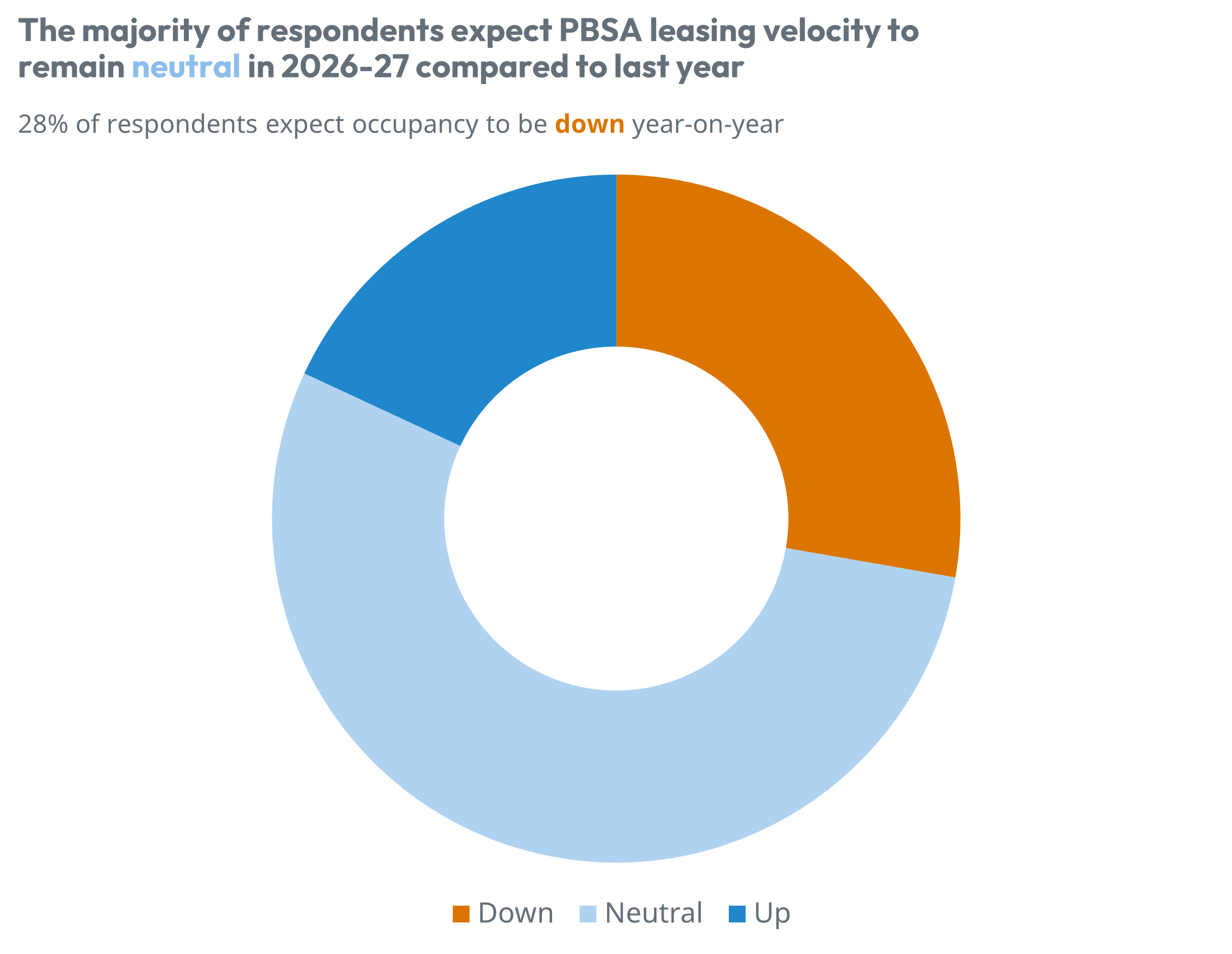

Moving to the topic of leasing velocity, we asked attendees about their expectations for 2026-27 occupancy rates compared to last year. A neutral outlook received 54% of votes, with 28% of attendees expecting velocity to be down year-on-year. Just 18% think next year will have improved leasing rates compared to 2025-26.

Source: StuRents' Annual Webinar

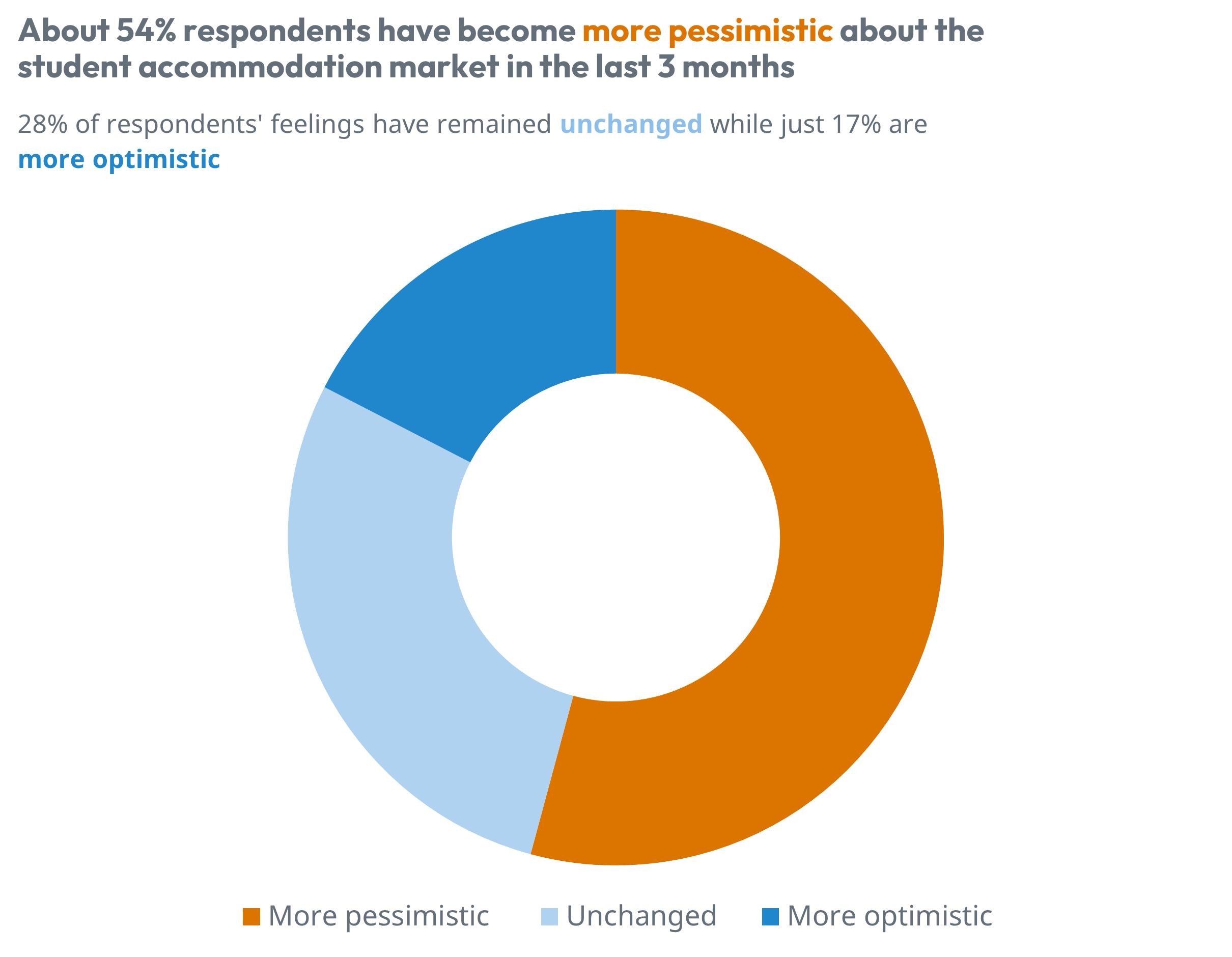

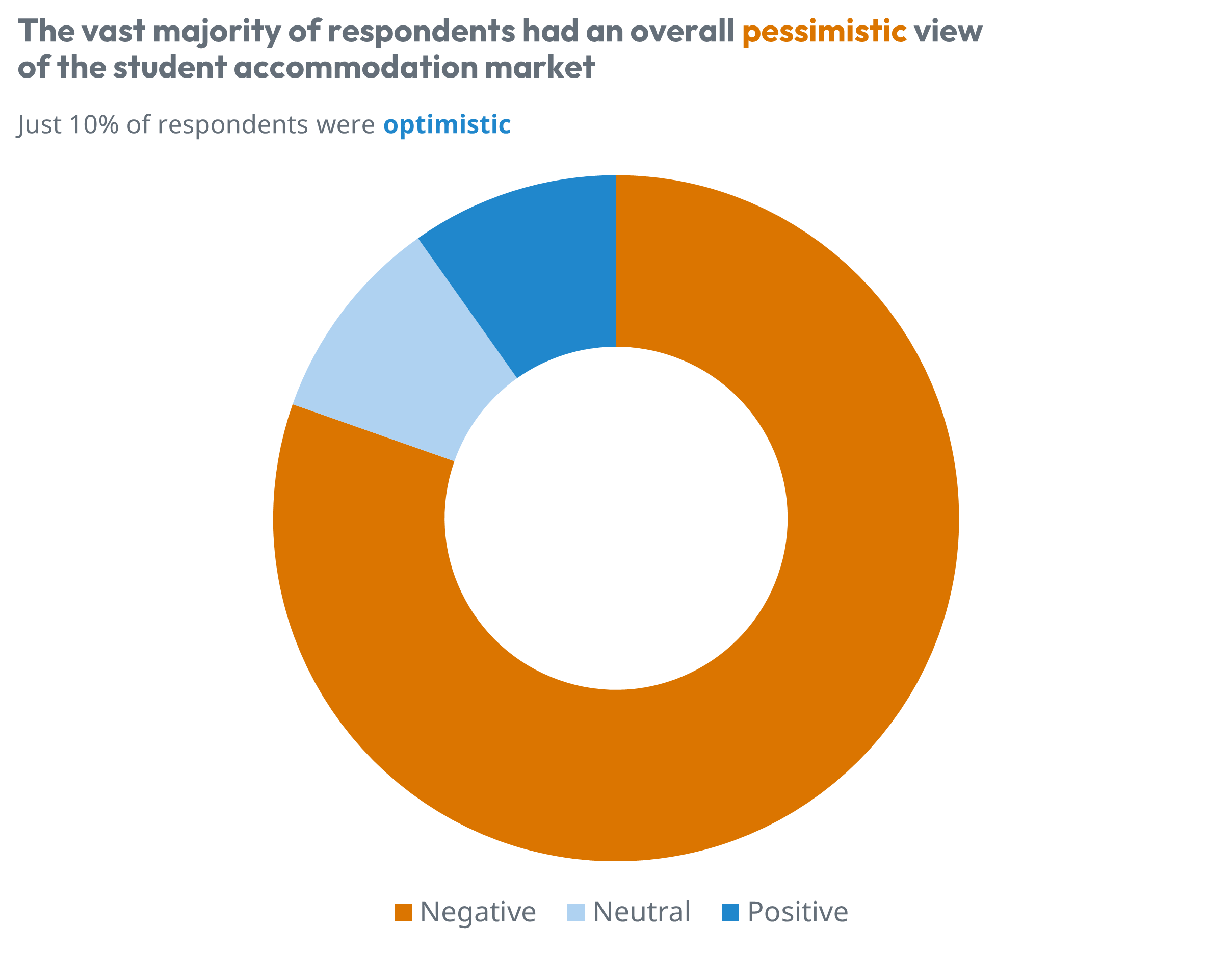

Finally, we asked webinar attendees how their view of the student accommodation market more generally has shifted in the last quarter. While 17% of respondents have become more optimistic, neutral or pessimistic responses make up the vast majority of votes, with more than half feeling negative about the market overall. This follows a tough year for occupancy, as well as an unclear picture of where student demand is heading.

Source: StuRents' Annual Webinar

Combining responses into an aggregated view (by assigning numerical values to optimistic, neutral and pessimistic responses), there was a pessimistic sentiment to the student accommodation market overall, with around 80% of respondents indicating negative or pessimistic sentiment across all three questions. While data indicates that planning activity and investment has been slowing, and many markets continue to lease slower compared to previous years, some markets are still facing a real shortage in student beds. The right kind of data is critical in identifying these city or intra-city locations and capitalising on the opportunities early.

Source: StuRents' Annual Webinar

For more information about our proprietary, highly granular data covering UK student accommodation contact the StuRents Research team today. Book a demo of our Data Portal to find out how you can have up-to-the-minute university housing insights at your fingertips, or get in touch with us about our Occupancy Survey.

Share