2026 Student Accommodation Trends to Watch

Image courtesy of Flickr

2026 Student Market Trends to Watch

With the first three months of the new cycle behind us and as we enter the new year, it's time to take stock and assess the key trends for the remainder of 2026.

A market set to rebound or a new normal?

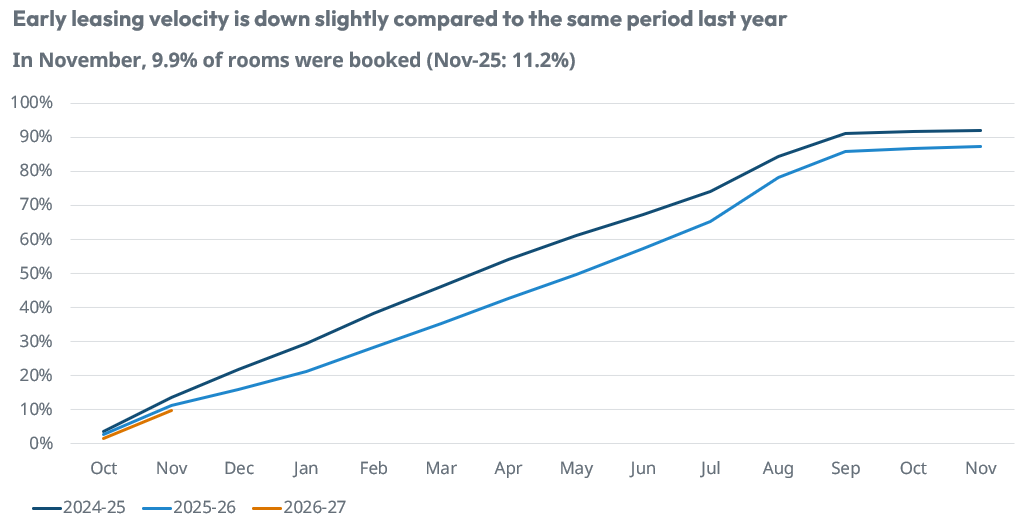

Early indications suggest some operators have kicked on with strong initial bookings, sometimes supported by incentives or year-on-year rental reductions. However, while some individuals have reported an improvement in early leasing velocity, nationally, our occupancy survey shows that on an aggregated basis, bookings remain slightly below the last cycle.

An expected decline in postgraduates, increasing PBSA supply, and a rise in live-at-home students were key drivers affecting performance in the last few cycles. But some markets do continue to report strong undergraduate growth, so they should be better positioned to see this demand flow through as 2nd and 3rd students this cycle, although time will tell if this can offset recent postgraduate declines and boost overall demand. What is certain is that incentives used over the last few years provide a clear signal to students to postpone booking, so leasing patterns could again be later than usual, making it hard to predict the end-of-year position. Some operators are already looking to break this cycle by offering best rate guarantees.

Micro location will remain key in a more competitive environment where not all schemes will achieve 100% occupancy. Those assets positioned well and at a suitable price will continue to outperform, but we expect more peripheral schemes or those not offering value for money relative to the competition to face challenges.

Entering the unknown - The Renters' Right Act

With the Renters’ Right Act (RRA) now law, all eyes will be on what impact, if any, it will have on the HMO market in 2026.

For example, those students already entered into their agreements are likely to take up their residences in July this year. If they do decide to leave their property early, say post exams, this isn’t likely to occur until May-Jun 2027. However, these same students will have already secured their next property (~Nov-2026) ahead of any impact. Therefore, landlords will have little visibility as to whether they can expect their tenants to remain in situ or if they are likely to move out, at which point they would be incentivised to bring forward their start dates as a countermeasure.

Another big unknown is whether landlords will bring forward their 2027 start dates or delay the beginning of the lettings cycle, so they are not in breach of the 6-month rule to permit Grounds 4A.

Alternatively, they may take the view that existing lettings patterns are so entrenched that students will automatically give up their property regardless. Grounds 4A can only be used if the agreement is signed no more than six months in advance of the move-in date.

Currently, there are two conflicting scenarios. A landlord letting their property ~November 2026 for the tenant to move in July-27 will be taking a risk, as they have no certainty that they can repossess their property in 12 months' time, as they won’t be able to benefit from Grounds 4A. But they could take the view that students will still want to move out during the summer. Alternatively, a landlord who decides not to sign their agreements until ~February 2027 so that they can benefit from Ground 4a could find themselves at a disadvantage if the majority of HMO beds in their market have already been let and demand has dried up.

This one could take a few cycles to play out to understand how both students and landlords will react.

Build-to-rent impact remains in focus

Build-to-rent supply and pipeline should remain a key focus for PBSA stakeholders, given its proliferation across certain markets. Those able to understand the full supply picture will be best placed to understand future opportunities and navigate risks created by this accommodation type. We expect interest in this sector and its impact on PBSA to remain highly relevant.

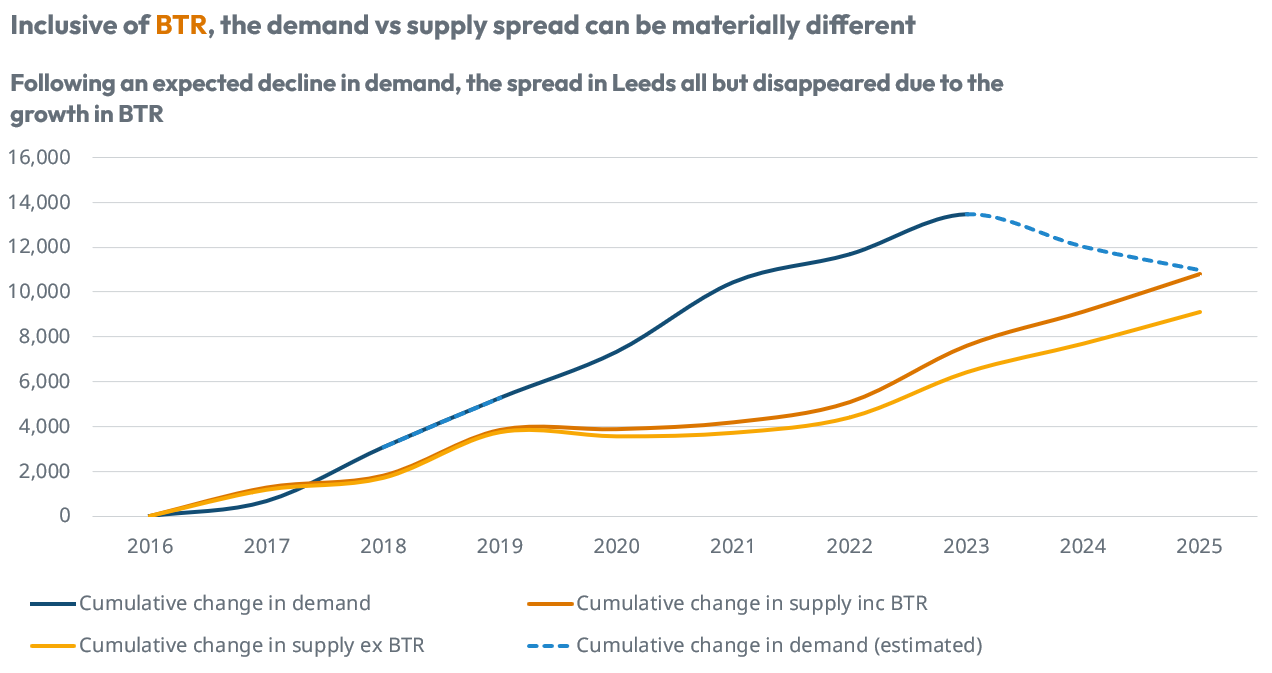

As highlighted below, in the example of Leeds, the change in demand vs the change in supply can look very different if a proportion of BTR is taken into account. When included, the spread between demand and supply growth materially narrows, resulting in a market appearing at saturation versus undersupplied - although in both scenarios, the city has become more competitive relative to when the spread was largest (2021-2022). A challenge for the sector is in what BTR assumptions to use when appraising markets. For example, what proportion of beds, not units, are being let to students? This input has the potential to significantly impact any sensitivity analysis. As always, the micro-location and the clustering of BTR schemes relative to PBSA supply will also remain crucial when appraising individual assets.

Note: BTR beds are assumed to be equal to 1.5* the number of units available, with 30% of BTR beds occupied by students. Demand for accommodation is assumed to have fallen post-2022, the latest year data is available from HESA.

Rental growth

In PBSA, rental growth for the 2025-26 cycle was muted, although there were huge variations between schemes. As we have also reported, the impact of changing tenancy lengths should be considered, given the huge impact, both positive and negative, that this can have on yearly revenue growth.

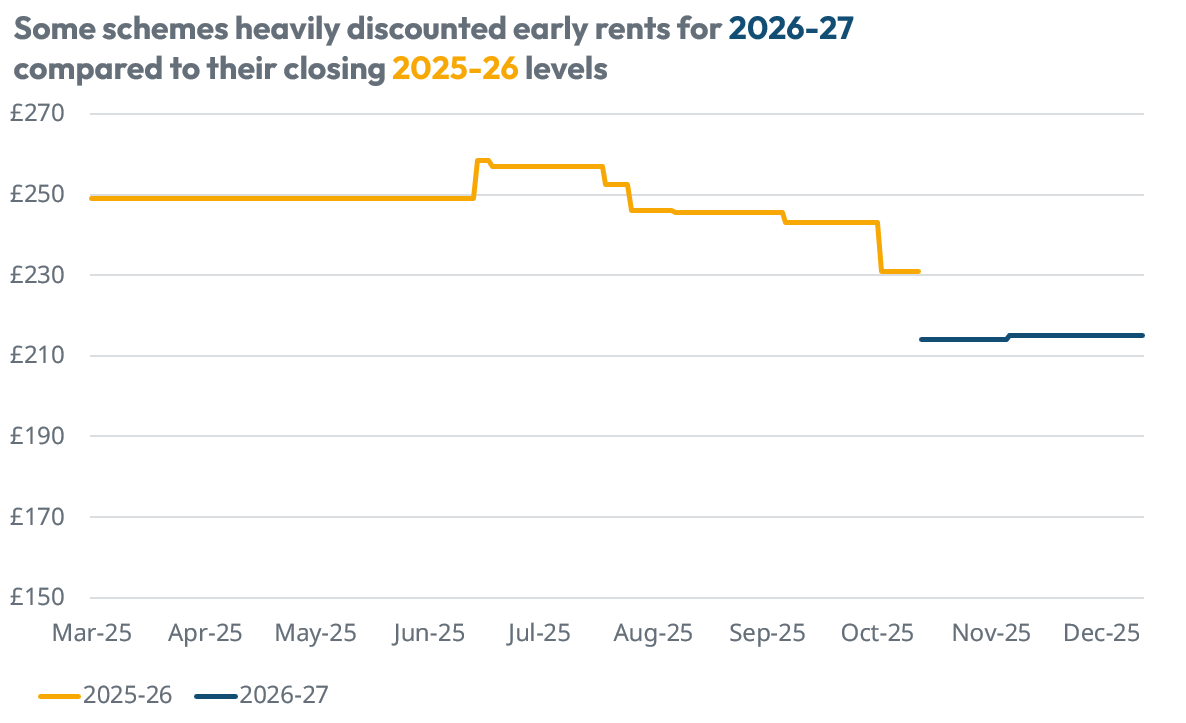

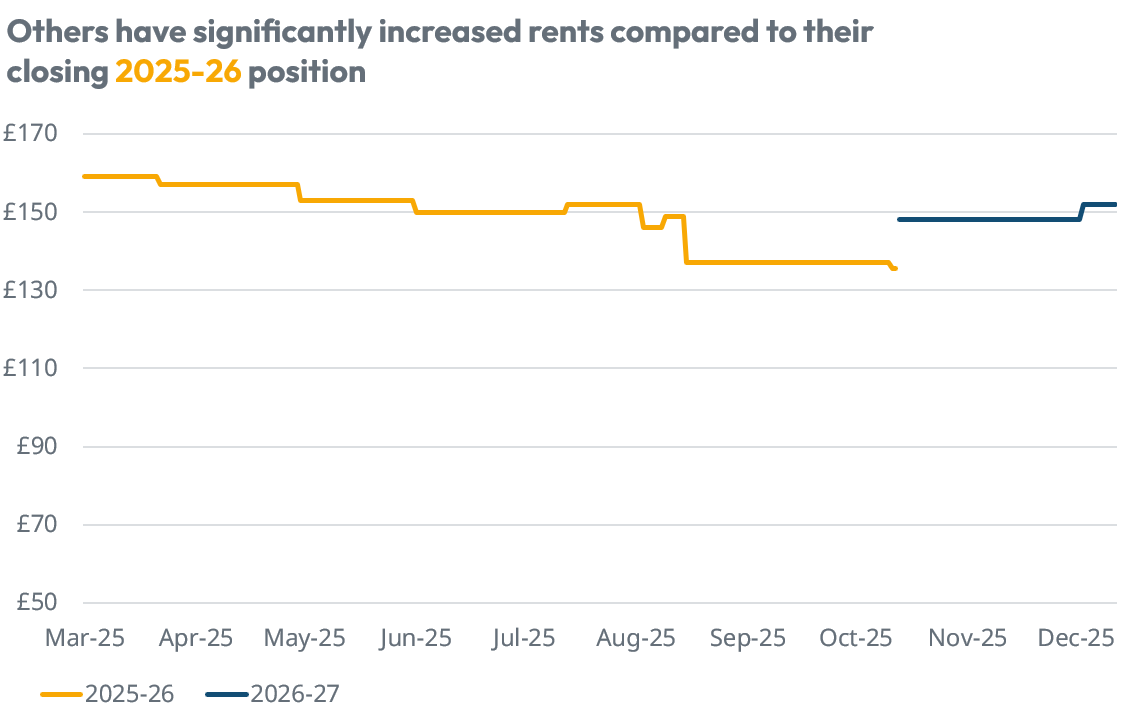

Expectations are for another mixed year, with affordability pressures likely to persist. We could also see a divergence in rental strategies. For example, some schemes have gone out of the gate with significant rental discounts compared to their closing position last year, as they look to gain early occupancy. Others have tried to push rents up, albeit sometimes from a lower base.

Note: Based on 51-week advertised rents only

2026 StuRents events roster

2026 sees the return of a packed events roster for the team, providing our members with the opportunity to network, gain unparalleled insight through proprietary data, and hear from other sector professionals.

Quarters Webinars

Our Quarters Webinar Series returns in early February, with timely updates on leasing velocity, planning, rents and the latest sector data.

MIPIM

The team will be attending MIPIM again in March and look forward to catching up with existing customers and making new connections.

Sector Roundtables

Our sector roundtables will continue to provide our partners with opportunities to understand the latest market trends, network with industry professionals, and have in-depth, thought-provoking discussions.

2026 Annual Summit

Following our highly successful event last year, 2026 will see the return of our Annual Summit in June, with hundreds of sector leaders due to attend. Bringing thought leadership and actionable data insights to attendees.

We will of course, also be attending a number of third-party conferences too. Reach out directly if you are interested in attending or taking part in our events.

Conclusion

Positive momentum in undergraduate demand will remain a driver for accommodation but a weaker postgraduate market and rising PBSA and BTR supply are likely to ensure the sector remains competitive this year. As a result, headline rental growth is likely to be closer to historical levels (1-2%), but stakeholders must bear in mind the impact of tenancy length, which can hide the real revenue growth.

Interest in 1st generational kit is likely to remain high due to affordability and viability challenges. Therefore, while opportunities will remain, stakeholders must remain highly selective and fully appreciate the latest trends, as well as local nuances, which will impact the ultimate success of a scheme.

We expect 2026 to be another mixed year. While the long-term outlook remains positive due to rising undergraduate demand, success will only come for those with the correct product at the right price.

Share