UCAS data points to nuanced demand growth

Image courtesy of Flickr

For UK student accommodation providers, the last few cycles have certainly been more challenging than in previous years, although as usual, there have been both underperformers as well as those tracking above the market. As we posited in our 2025 UK Student Accommodation Report, declines in postgraduates have dragged down total demand, which has subsequently been confirmed by the latest HESA data.

This has also been reflected in our latest Occupancy Survey results, with the proportion of beds booked for the 2026-27 season reported at 15.2% in December, versus 16.0% at the same time last year.

While volatility has plagued the market in the last few years, undergraduate growth remains a continued bright spot, with the total number of yearly acceptances jumping by 2.3% in 2025. However, these headline figures can mask important details with regard to specific locations or institutions. This reinforces our view that the devil is in the details, and relying on broad datasets or metrics no longer provides the insights needed to make informed decisions.

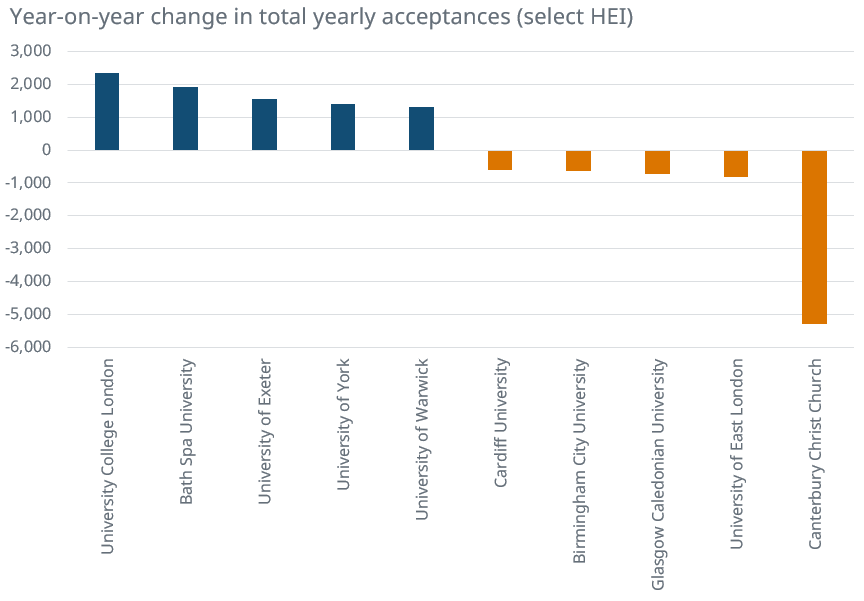

We’ve already reported on the national-level data via our annual report, but isolating select institutions raises some noteworthy trends.

UCL reported an increase in yearly acceptances of more than 2,300 in 2025, equating to growth of 25.8% year-on-year. Meanwhile, Bath Spa University also saw numbers increase significantly, with numbers jumping by ~1,900 (+33.6%). At the other end of the spectrum, Canterbury Christ Church saw numbers plummet by 5.3k or 35.1% year-on-year.

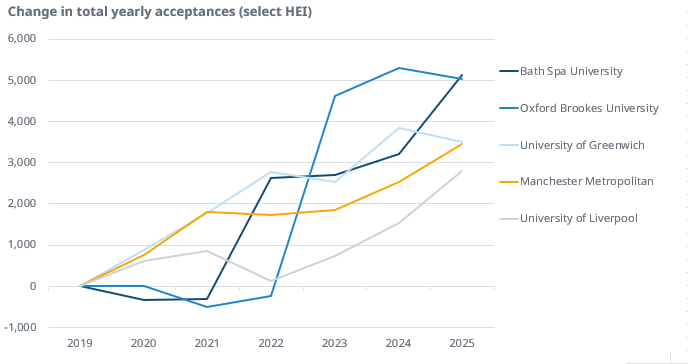

Considering the data over a longer period can be useful for understanding how an institution is developing over time. For example, while Oxford Brookes reported a decline in total acceptances in 2025 (-2.6%), numbers remain up by more than 100% compared to 2019, equating to an additional 5,040 acceptances. Bath Spa University reported a notable jump last year, ensuring there were 5,134 more acceptances in 2025, relative to 2019.

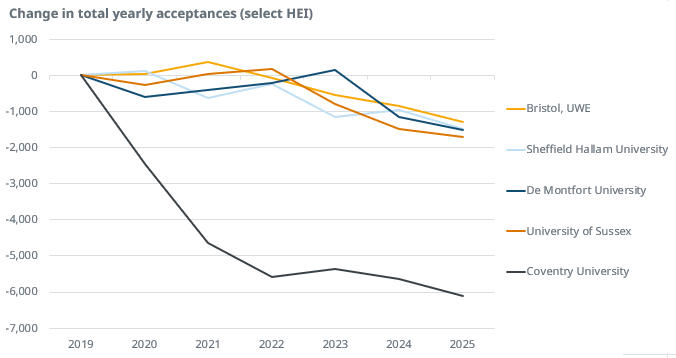

Not all universities have reported growth over the long term, with performance divergence remaining a key sector trend. Coventry University has seen total yearly acceptances fall by more than 6,000 since 2019, which partly explains the challenging conditions the city has faced in more recent years.

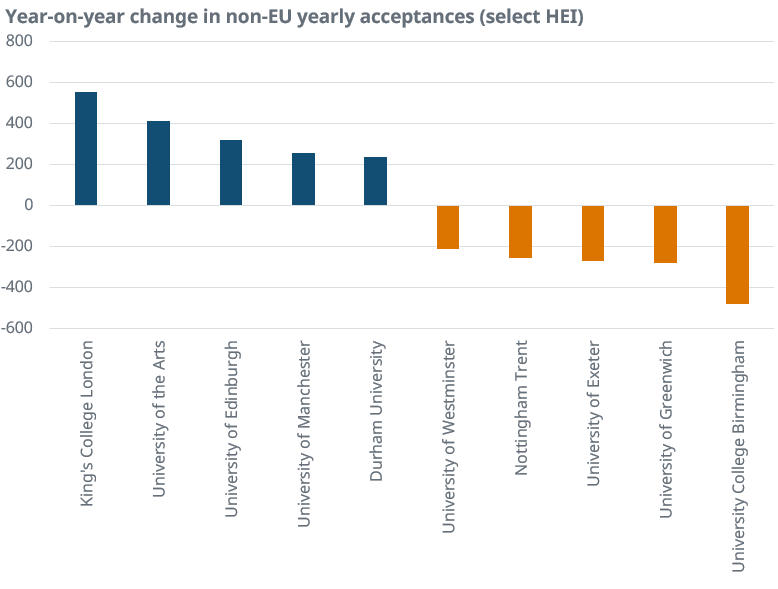

Non-EU students remain a key demographic for PBSA in particular, and the distribution of year-on-year changes between institutions remained significant. King’s College London saw numbers jump by more than 25% or 555 acceptances compared to 2024. The University of Arts and the University of Edinburgh also reported substantial increases in absolute terms. Meanwhile, University College Birmingham saw non-EU acceptances fall significantly in both percentage and absolute terms. Nottingham has been a market of particular interest more recently due to shifting dynamics, and in 2025, Nottingham Trent reported a year-on-year fall of 22.7%.

At an aggregated level, a return to growth (+7.9%) in non-EU acceptances will be welcomed by the sector. However, this headline figure hides some important details.

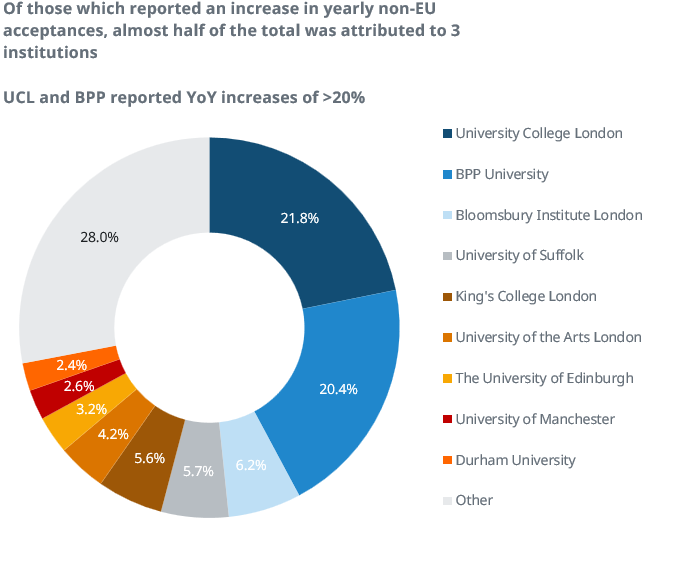

As highlighted below, of those institutions which reported an increase in non-EU acceptances in 2025, a significant proportion was attributed to just two institutions. Combined, University College London and BPP University reported a jump in yearly acceptances of almost 4.2k, compared to the increase nationally of 4.7k.

Excluding these two institutions, aggregated growth across all other providers was a much more modest 1.0% year-on-year. This highlights the importance of having a deep understanding of the data beyond the national trends.

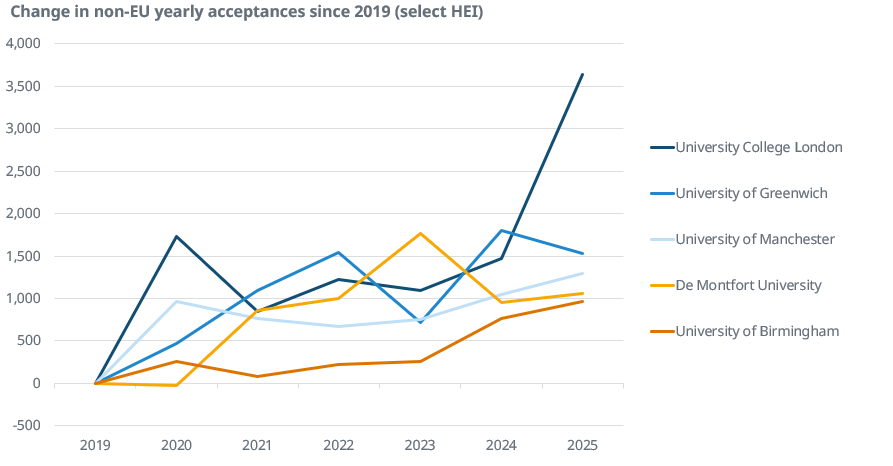

While the headline could be described as being less positive than it first appeared, there remain long-term winners. The University of Greenwich reported 1,525 more yearly acceptances from non-EU students in 2025 compared to 2019. De Montfort University and the University of Birmingham have also reported notable increases over the longer term.

Elsewhere, the University of Sussex has reported substantial declines in the past few cycles, resulting in 635 fewer yearly acceptances in 2025 compared to 2019. Newcastle University reported a further decline in 2025, as did the University of Exeter.

Share