Student Accommodation Research: HMO Rental Growth

Key Findings

- Like-for-like HMO rents in Durham have increased by an average of ~18%.

- Last year, 75% of all HMO enquiries in Durham were made by November.

- Fewer than 15% of HMO beds analysed in Durham were priced at £120pppw or less.

- More than half of HMO beds analysed in Durham cost £150pppw or more, versus 19% last year.

- Average HMO enquired price in Durham of £151pppw.

StuRents Research - Early HMO Rental Growth Indications

With the 2023-24 lettings cycle now underway, the StuRents research team has begun to analyse advertised HMOs to offer an early insight into rental growth.

The dramatic rise in utility costs over the last 12 months has been well reported and whilst some of the larger operators in the sector, particularly those of PBSA are hedged against these rises, there will be many in the sector who are not.

Rising utilities, coupled with a jump in mortgage costs following the disastrous mini-budget last month will likely put some landlords under considerable strain, although it remains a fluid issue and much could still change on this front following the appointment of the new Chancellor Jeremy Hunt.

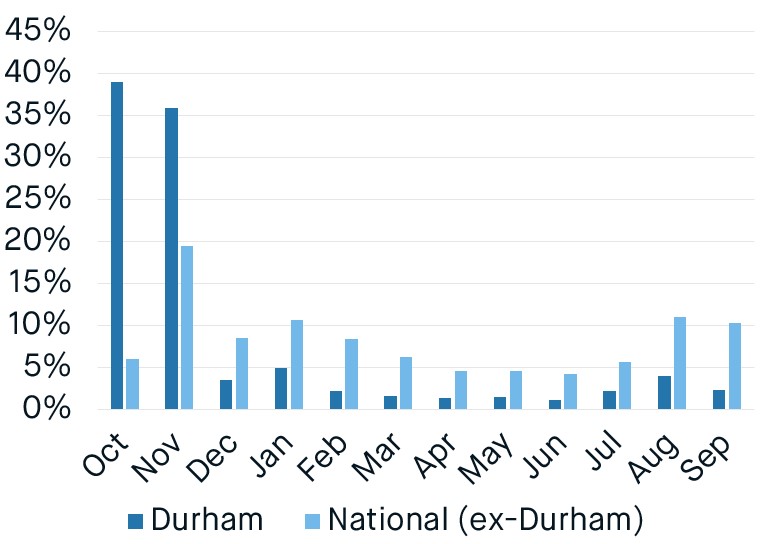

Durham remains one of the earliest moving markets, with 75% of all HMO enquiries last season occurring by the end of November. In comparison, at a national level (excluding Durham), this same figure stood at 26%. As a result, the city can be a useful bellwether for understanding what students could face in other university towns and cities as more properties begin to be released.

Figure 1: Monthly HMO Enquiry Distribution 2022-23

In Durham, reports have emerged of students camping overnight outside estate agents to secure their accommodation for the 2023-24 season in what the union has described as a broken market.

Not only are students having to secure their accommodation earlier than ever, sometimes even prior to visiting the property, but they face significantly higher rents too.

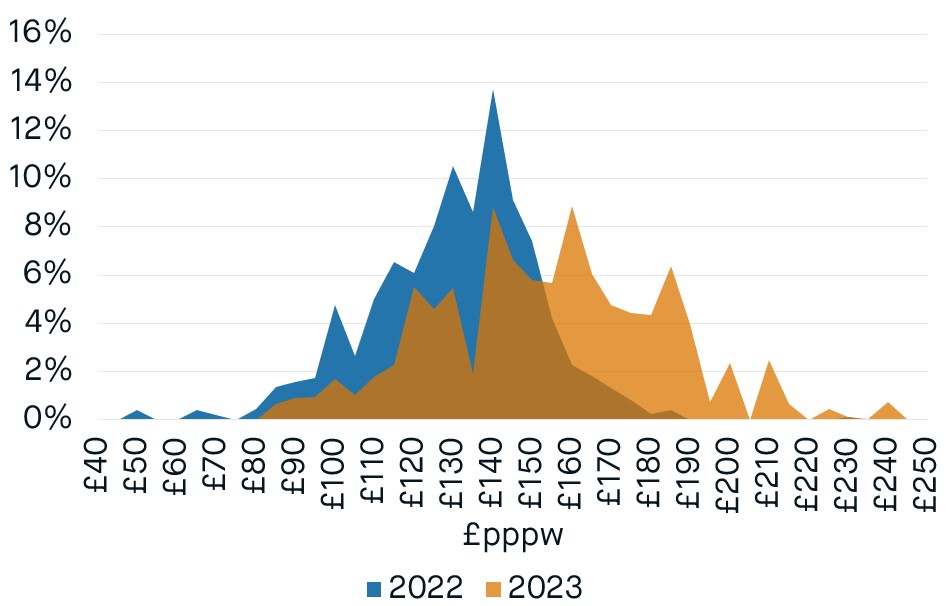

Figure 2 highlights the distribution of advertised rents for HMOs for the last season (2022-23) versus the current cycle (2023-24).

It is immediately apparent that the cost of HMOs in Durham has risen considerably. On a like-for-like basis and at the time of writing, the average advertised rent stood at £154pppw versus £130pppw in 2022-23. This represents a substantial increase of >18% year-on-year.

Of those properties included in the analysis, last year ~31% of HMOs were priced at £120pppw or less. In comparison, for the 2023-24 season, fewer than 15% of properties were priced at this level.

Meanwhile, more than half of HMO beds are priced at £150pppw or more, whilst for the 2022-23 season, just 19% of beds cost this much. Looking at the HMO properties in Durham that have been enquired for, so far this year, the average stands at £151pppw, reflecting the significant increase in advertised rents this year.

Figure 2: Durham HMO Price Distribution

Not only has the average cost of HMOs in Durham risen dramatically, but some properties have also reported increases well above this.

Looking ahead, the fundamentals around rental growth remain in the landlord's favour. Durham is a well-respected and prestigious university and as such has remained popular amongst students. The latest data available from HESA, which covers the 2020-21 academic year, highlights the continued growth in the student body.

In 2020-21 there were more than 19.5k full-time students, with the vast majority of these (+90%) requiring accommodation. At the same time, there were fewer than 11k beds available via purpose-built student accommodation (PBSA), the supply of which has been unchanged since 2020. Whilst houses in multiple occupation (HMOs) remain popular amongst students, the lack of PBSA growth exacerbates the pressure on local housing stock, whilst ensuring stiffer competition between students for the best available accommodation.

Whilst the situation facing students in Durham is not unique, it does illustrate how in the face of rising demand, students are the ones who will bear the brunt of a lack of housing.

Share