PBSA Growth Continues to Slow

Key findings:

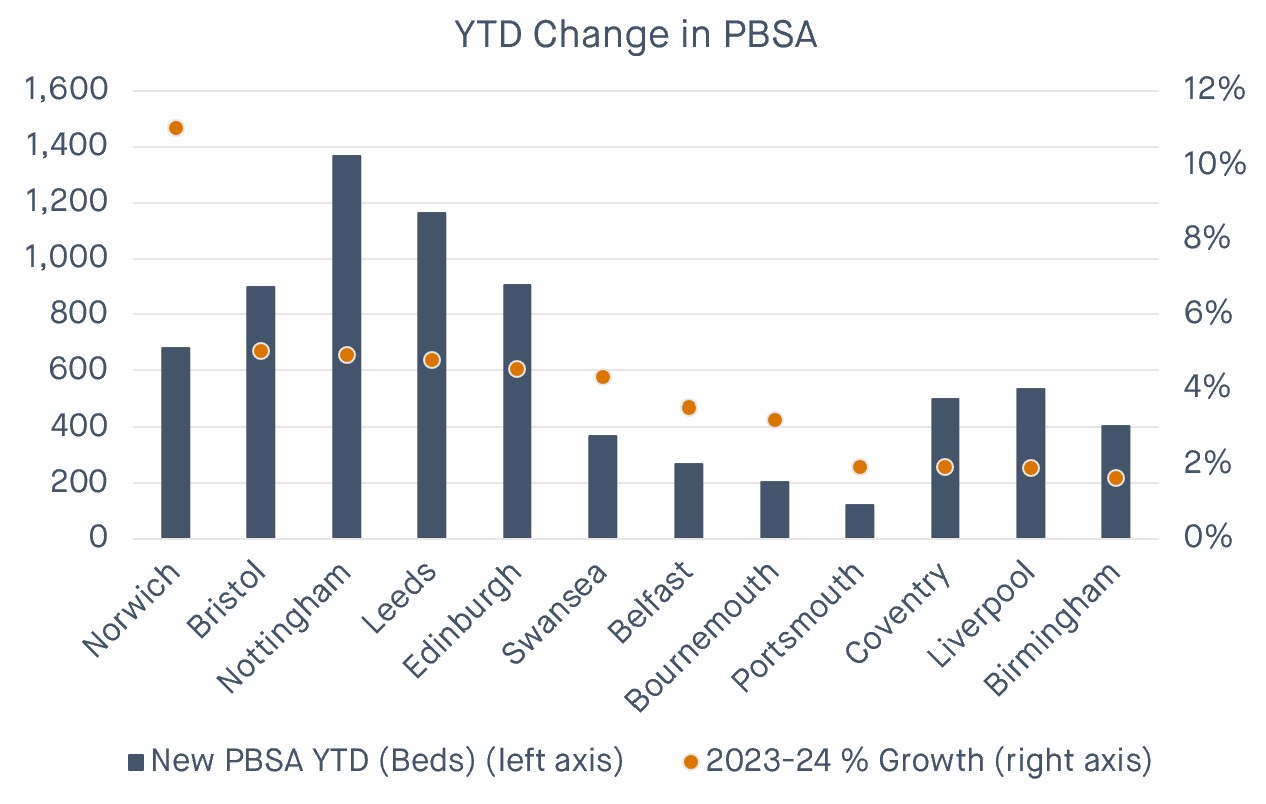

- Year-to-date, the supply of purpose-built student accommodation (PBSA), has increased by just 1.5% year-on-year

- In percentage terms, Norwich and Bristol have reported the largest increases so far

- With planning application activity at low levels and various cost pressures still at play, future growth is likely to remain limited

- Supply and demand growth misalignments are creating both opportunities and challenges at a local level

PBSA Growth Slows Again

For the 2023-24 lettings cycle, the number of new beds confirmed to be live has continued to slow compared to previous years. Whilst the final figures will change over the coming months, around 10k units are due to become operational in time for the new academic year.

This compares to more than 35k beds delivered in 2019 and 19k in 2022, highlighting the continued slowdown in the delivery of new PBSA. However, whilst national growth in PBSA has been limited, as usual, there are significant locational variances.

As highlighted below, Norwich has reported a substantial jump in the supply of PBSA, with beds growing by ~11% year-on-year. In absolute terms, Nottingham has seen the largest increase for 2023-24 with bed numbers growing by almost 1,400 units.

Source: StuRents

Planning Activity at Low Levels

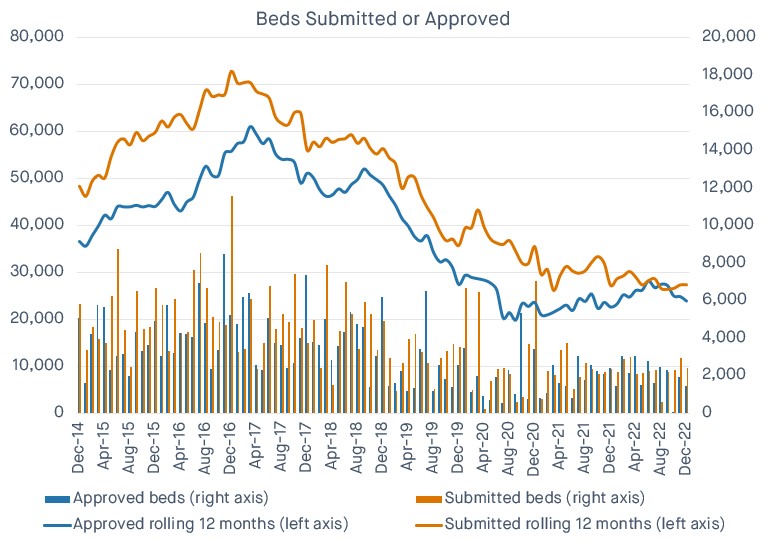

Reflecting the slowdown in planning application activity, the chart below highlights the number of student beds either submitted or approved since the end of 2014. The data illustrates that planning activity has been in decline since its peak in 2016, with significantly fewer beds being submitted or approved compared to previous years.

For example, in 2016 more than 72k beds were put forward, with 56k being granted planning permission. In 2022, this fell to just 27k and 24k respectively. This decline is unlikely to be attributed to any one factor with fewer appropriate sites, local oversupply, competing land uses, and rising build or financing costs all likely playing a part.

Source: StuRents

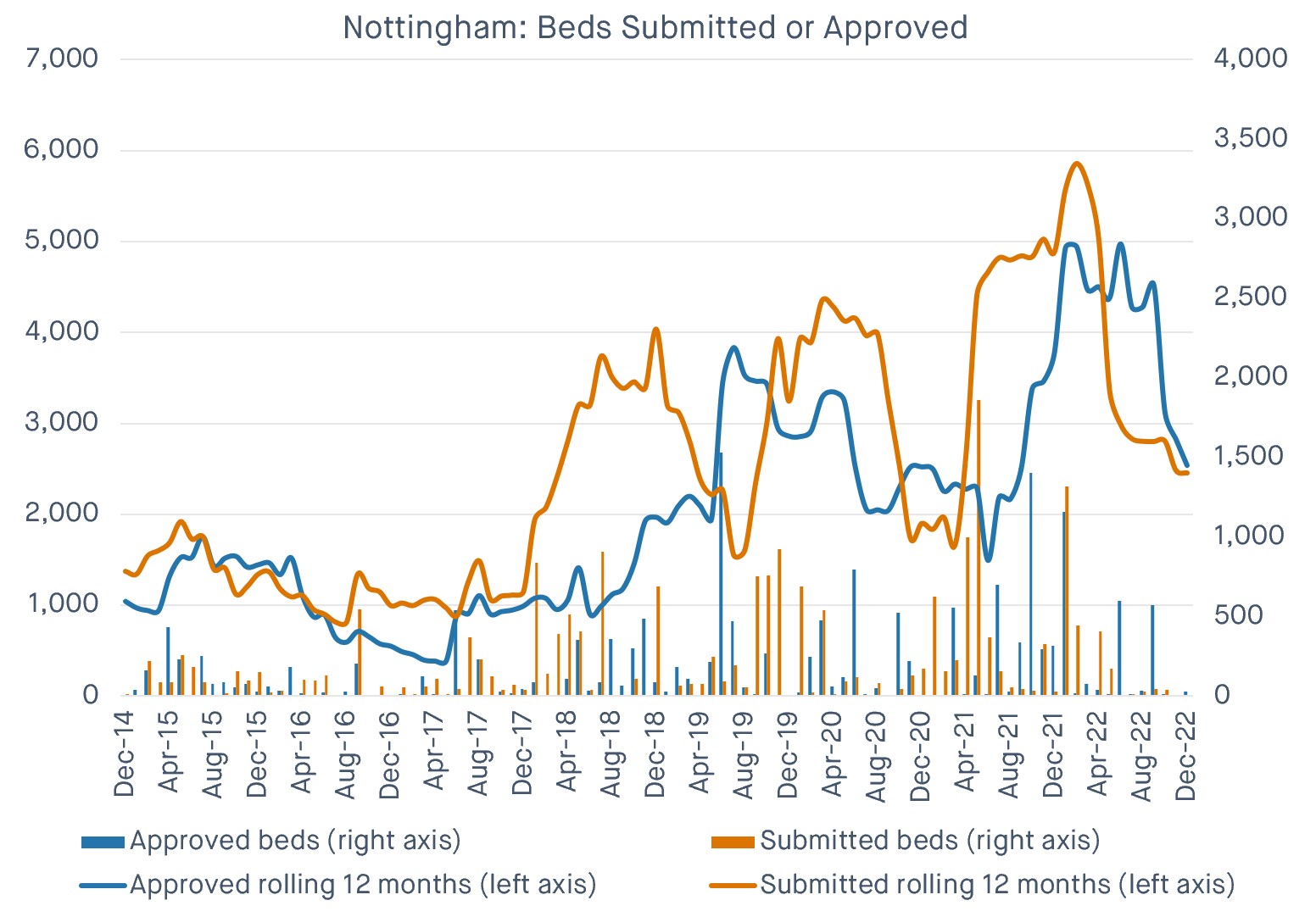

Whilst nationally, the slowdown in planning is apparent, certain locations have reported an influx in activity. For example, in Nottingham, developers and investors have been falling over each other to deliver more supply following a rapid rise in demand. As highlighted below, there has been a clear upward trend in recent years, with Nottingham having one of the largest pipelines outside of London.

Source: StuRents

Local Misalignments

Although the undersupply of PBSA at a national level is well reported, it is worth reiterating that each town or city has its own fundamentals and a national shortage of beds does not mean all locations can absorb more stock. Furthermore, with new scheme taking years to come to fruition, the market fundamentals at the point of practical completion could be very different to those when an application is put forward.

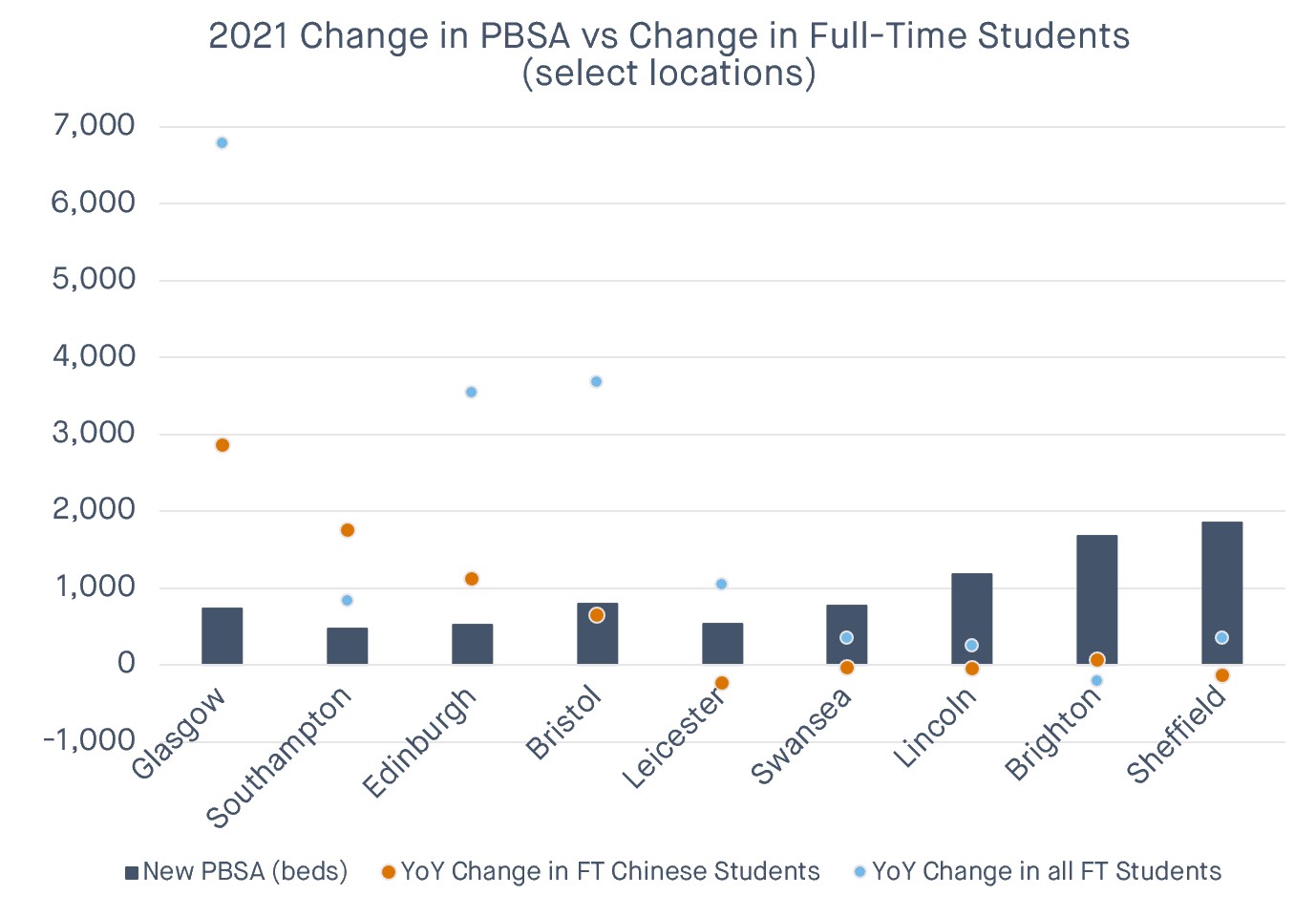

Looking at the misalignment of supply and demand growth in more detail, it's worth highlighting a few of the locations where the two have not been well aligned. The University of Glasgow has faced significant issues due to overrecruiting during Covid and this is reflected in the chart below. It indicates that in 2021 alone, more than 6,500 additional students attended institutions in Glasgow, with almost 3,000 more Chinese students year-on-year.

However, the supply of PBSA beds grew by fewer than 1,000, exacerbating an already tight market. At the other end of the scale, student accommodation in Sheffield has increased with delivery of ~1,800 beds, whilst total full-time students grew by just 345.

Source: StuRents

The UK student accommodation market is rapidly changing. Demand growth at some institutions has been significant in recent years, whilst others continue to struggle with recruitment, as recently highlighted at the University of East Anglia. However, demand is only one side of the equation and having access to granular student accommodation research is critical when appraising a given location or opportunity.

To discuss how StuRents can help your business better understand both opportunities and risks reach out at Research@StuRents.com or visit StuRents.com/Research for more information.

Share