UCAS data points to recruitment volatility

UCAS has now released their data for the end of the 2023 application cycle. This end-of-cycle data highlights trends regarding applications and acceptances to courses through UCAS in the 2023-24 academic year. We're analysing the yearly acceptance rates for both EU and non-EU students and reflecting on how emerging trends, including dips and declines in acceptance rates for non-EU students, could affect the wider student accommodation market.

Acceptances

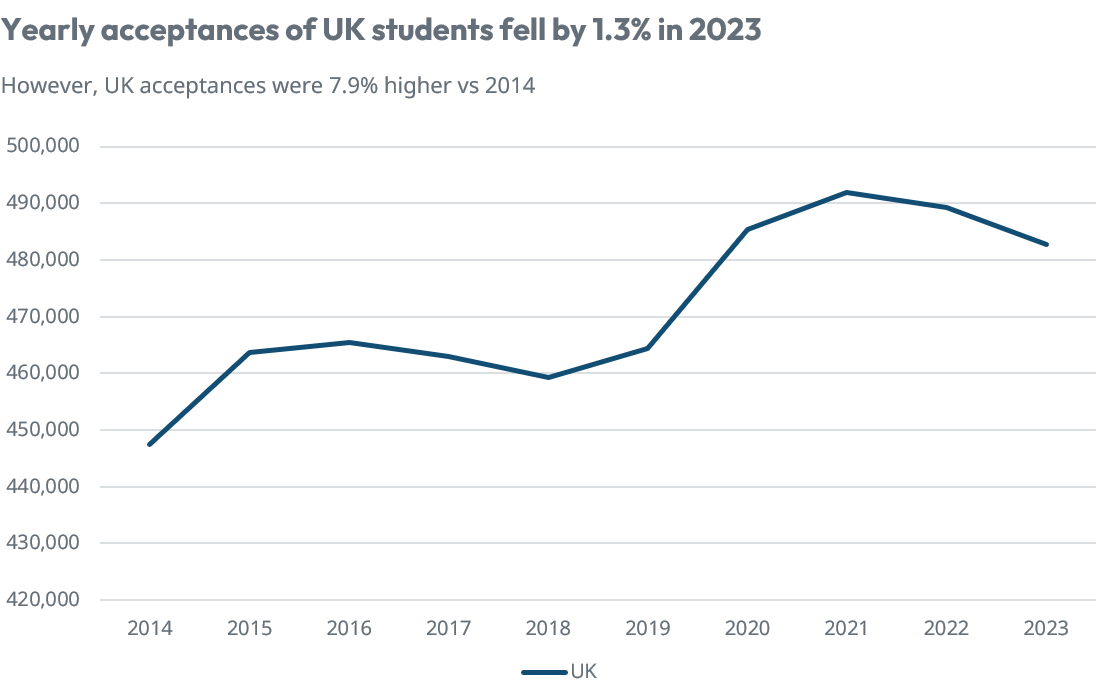

Nationally, acceptances for the 2023-24 fell year-on-year (YOY) by 1.5%, with declines reported across all demographics. The most significant fall was attributed to EU students, with numbers dropping by a further 7.3%. This reflects the broader decline reported since Brexit, which has resulted in a collapse in EU demand, albeit the overall impact on total demand has been limited.

Source: UCAS

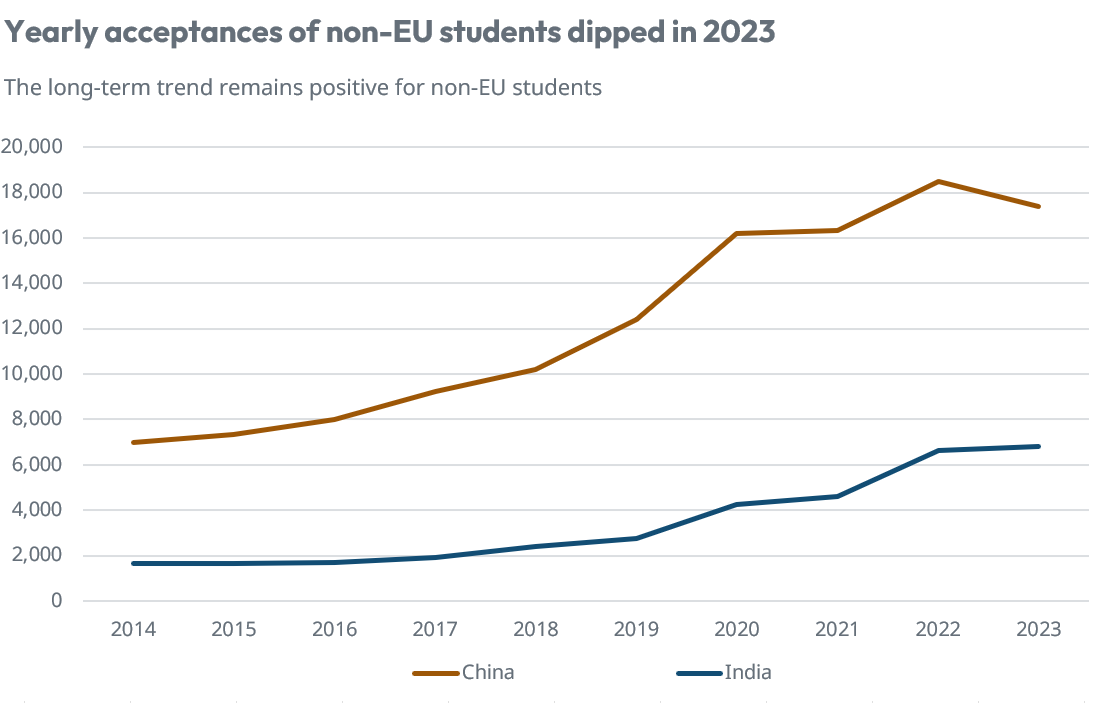

A bigger concern, particularly for the PBSA market, will be the drop in international (non-EU) students. However, as highlighted below, the long-term trend remains very much positive, with 58.4% more acceptances from this demographic in 2023 compared to 2014.

Source: UCAS

Looking at this demographic in more detail, specifically Chinese and Indian demand, we can see the national trend is reflected by these countries. Take China, for example. While yearly acceptances fell by almost 6% in 2023, they were still up by 149.4% compared to 2014.

Further complicating this trend is the continued impact of Covid. The last few years have witnessed a level of volatility not recorded in previous years, attributed to pandemic lockdowns, the subsequent reopening of borders, grade inflation and then deflation, and more. The question, therefore, is whether this recent decline in Chinese demand is simply an adjustment to the bumper years seen in 2020 and 2022 when acceptances jumped by 30.4% and 13.4%, respectively, or a systemic slowdown in demand growth.

Source: UCAS

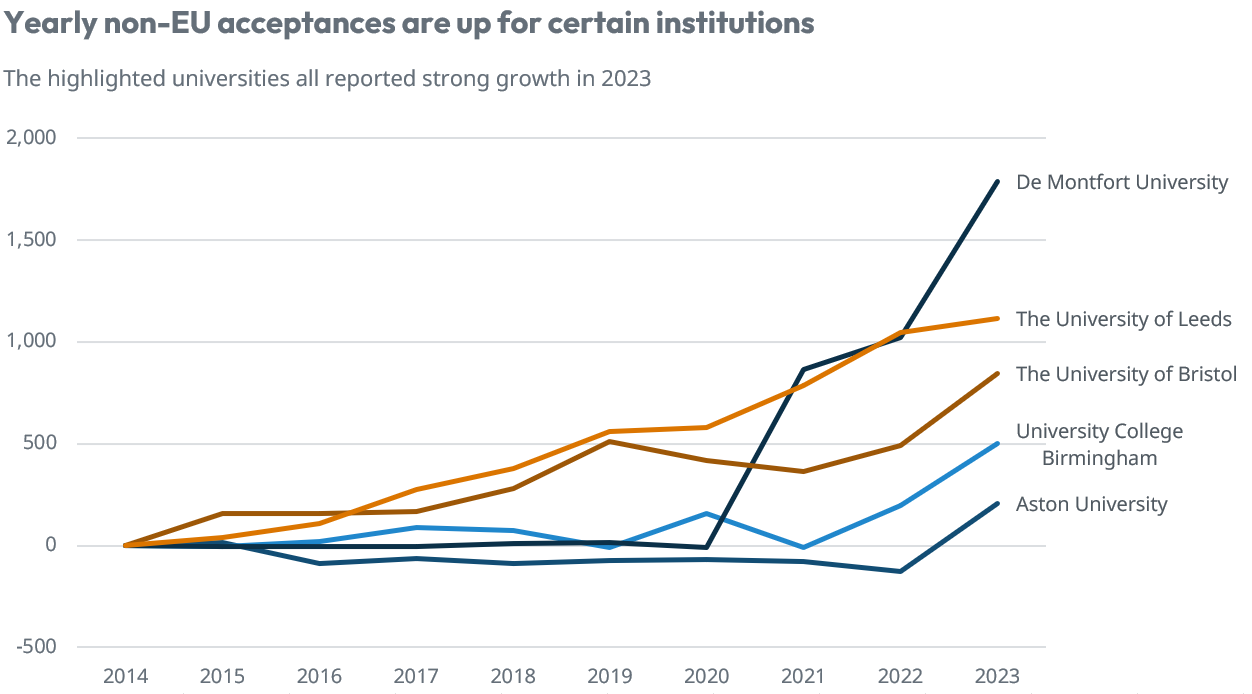

As always, national trends do not give us the data needed to make informed decisions at a city level, and here, the trends can vary significantly between institutions.

As highlighted below, the following universities all reported strong growth in 2023, with De Montfort University recording a jump of 67.1% in non-EU acceptances, the equivalent of an additional 1,785 students.

Even among those universities that have reported falls in 2023, in many cases, numbers are still up compared to historical levels. In the example of Nottingham Trent University, it reported a decline in non-EU acceptances of 29.6% YOY but at 760 acceptances in 2023, this still represents an increase of some 347.1% compared to 2014.

Source: UCAS

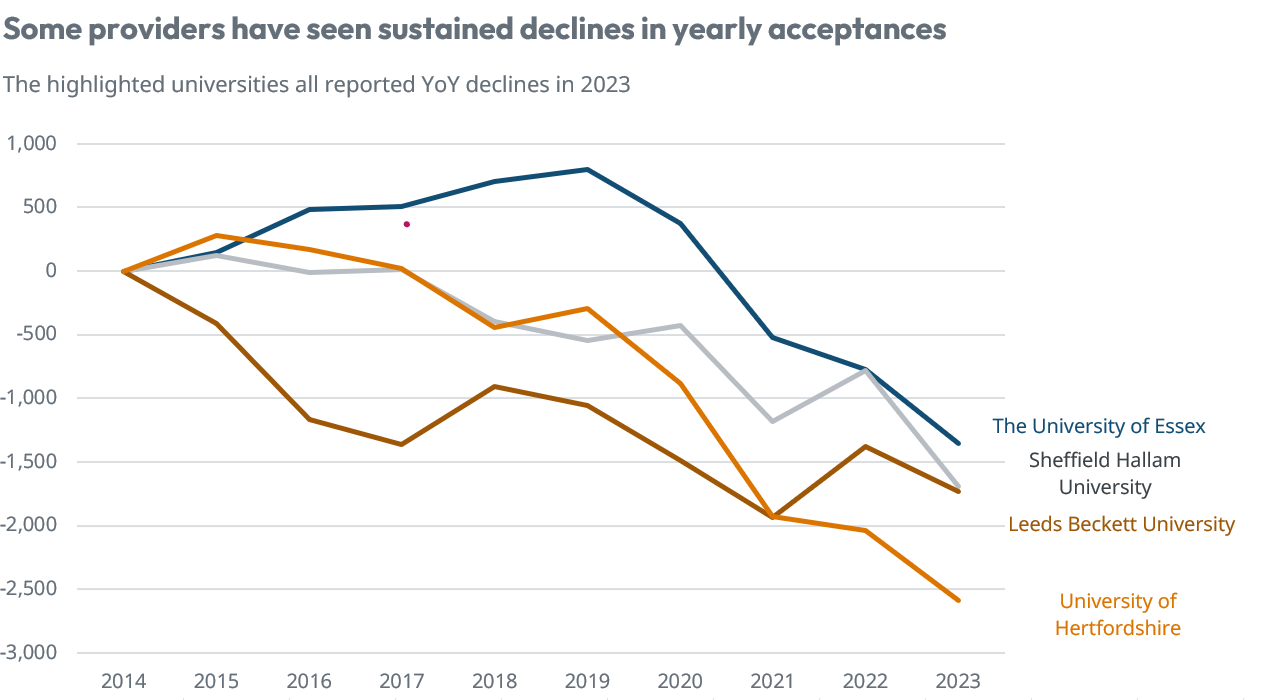

However, it's not all rosy, with certain universities reporting both YOY falls as well as declines over the long term. The University of Essex, which has had reported recruiting issues, has seen its total yearly acceptances fall by 36.0% compared to 2014. Equally, the University of Hertfordshire recorded 2,590 fewer acceptances in 2023 compared to 2014, representing a fall of 47.9%.

Source: UCAS

As highlighted above, the national trends that are typically reported on, do not necessarily reflect the developments reported by individual universities. As a result, when appraising local markets it's important to recognise the nuances of demand in that city or even at a specific university within that location.

About StuRents Group

StuRents Group operates StuRents.com, the UK's leading student accommodation marketplace, listing 750,000+ rooms across 100 university towns and cities.

Concurrent is part of StuRents Group and powers the full rental journey, helping property managers find tenants faster, execute tenancies seamlessly, automate rent reconciliation and report on critical financial and operational data.

StuRents Intelligence, our research division, provides unbiased, proprietary insights leveraged from StuRents.com and Concurrent.co.uk to property managers, investors, developers and lenders industry-wide.

Share