Top 5 Student Accommodation Trends - June 2023

Our Head of Research, Richard Ward, presented the latest industry trends at this year's LD Student Housing Conference on May 9th. We take a look at some of the key takeaways.

Key findings:

- More students are living in PBSA but HMOs continue to play a vital role, equating to more than 50% of beds

- Domestic students still prefer HMOs over PBSA

- Pipeline activity remains low by historical standards leading to a slowdown in the delivery of new stock

- Local misalignments between supply and demand growth are creating both opportunities and risks

- Not all demand growth is equal, demographics are changing, leading to implications for product fit

Supply Overview

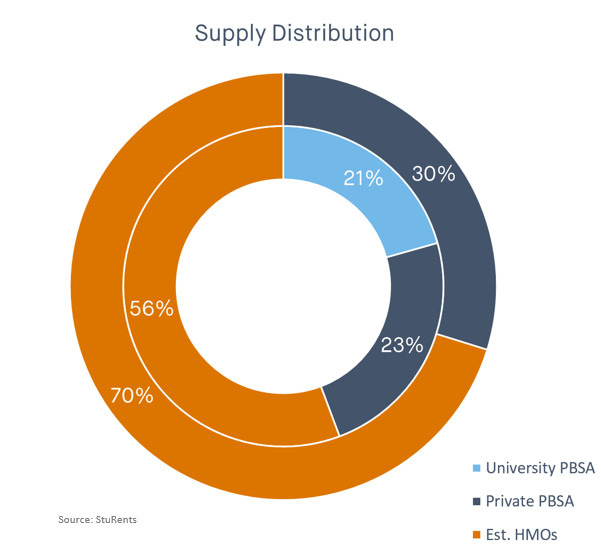

While deals such as Greystar's and GIC's acquisition of Student Roost typically grab the headlines, it's worth taking a moment to recognise the important role HMOs play in providing accommodation to students.

Nationally, across all accommodation types, HMOs equate to more than 50% of beds. Excluding university-managed accommodation this jumps to ~70%.

Whilst HMOs continue to play a significant role, the number of PBSA beds available to students has been on the rise, driven predominantly by the private sector. As such, more students are choosing to live in PBSA. The role PBSA has played in lifting the availability of quality accommodation in the sector also cannot be overstated.

Looking ahead, the majority of beds in the supply pipeline are being proposed by private PBSA operators. As a result, the share of beds managed by universities is expected to fall further.

Product Fit

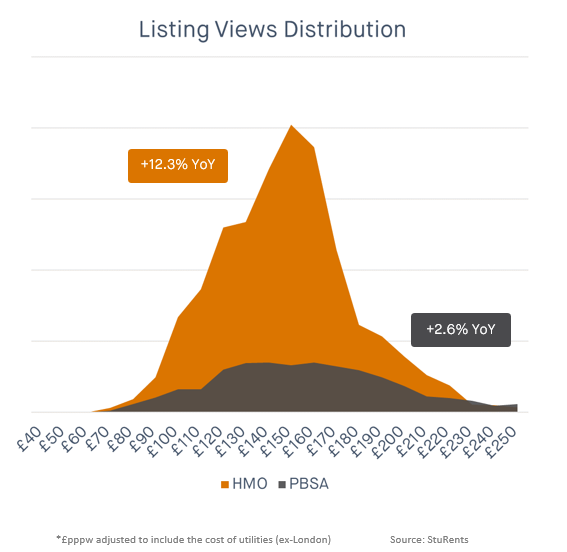

Isolating demand from UK-based students, StuRents is able to utilise the millions of data points generated through StuRents.com to better understand search behaviour and accommodation type preferences.

The chart below highlights the distribution of property listing views by price and type. The preference to view HMO properties is clear, with an average listing view price of £150pppw inclusive of bills (ex-London).

Conversely, searches made by East Asian students suggest a preference for PBSA, with the majority viewing this property type, which typically commands higher prices too. Last year, the average listing view price from East Asian students was ~£190pppw (ex-London).

Pipeline

Planning application activity continues to remain at relatively low historical levels, which has led to a reduction in the number of new PBSA being delivered. For the 2023-24 lettings cycle, ~11k new beds are expected to become operational in time for the new academic year, down from ~37k reported in 2019.

Local misalignments

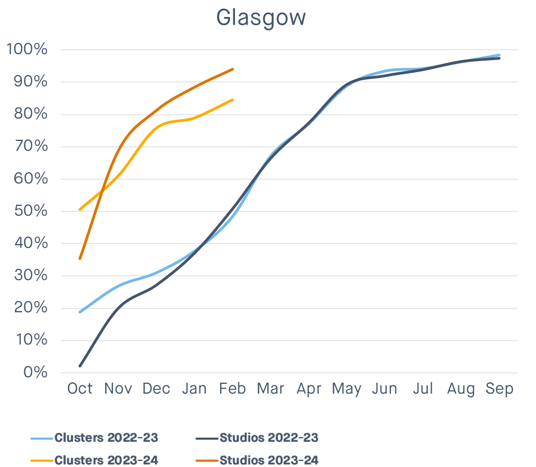

Whilst nationally the issue of undersupply has been well documented, the supply and demand fundamentals do vary significantly per location.

In some markets the delivery of new PBSA has far outstripped demand growth, leading to some challenging fundamentals for operators. At the other end of the scale, in a location such as Glasgow which arguably over-recruited during Covid, the reverse has been true.

This is reflected in the latest booking velocity data, which shows the proportion of PBSA beds booked in Glasgow is up significantly year-on-year.

Not all growth equal

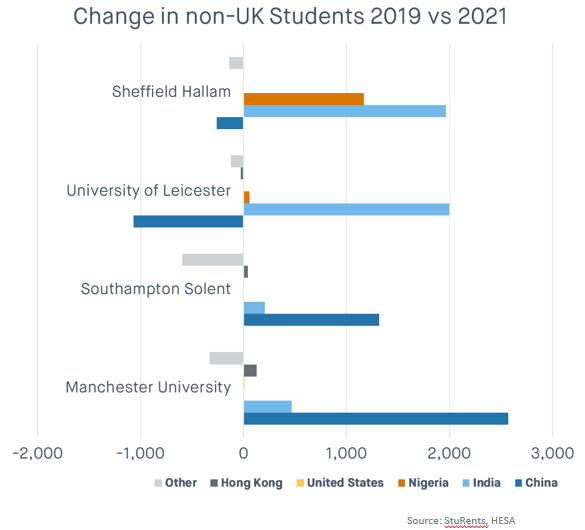

Understanding changes to demographics is critical for determining product fit as well as the most appropriate marketing strategies. In the examples highlighted below, all of the institutions have reported growth in "international" students over the reported period.

However, this growth differs between institutions. At the University of Leicester, the number of full-time Chinese students has declined, which will have a direct impact on the level of demand, particularly for high-end rooms. Over the same period, the number of Indian students at the university has increased. This particular demographic has a different budget profile as well as unit mix preference, which again will impact the product fit of both existing and future schemes.

Summary

As always, the data highlighted above shows that each individual town or city can vary significantly and that understanding current and future changes to demand profiles is key in determining the likely success of a scheme. Nationally, the future of student accommodation looks bright, however, with various headwinds apparent, the next challenge will be how the market meets the growing demand for student accommodation.

To discuss how StuRents can help your business better understand both opportunities and risks reach out at Research@StuRents.com or visit sturents.com/research for more information.

Share