Student Accommodation Research: Q1 Market Supply

Q1 Market Supply

The StuRents Q1 Quarterly Reports are now available!

Every quarter, the research team at StuRents compiles reports for 46 university cities and towns across the UK, plus a national report for the UK. In Q1, a key section of the reports explores updates to market supply and the supply pipeline.

Planning Activity

Source: StuRents Limited, relevant councils

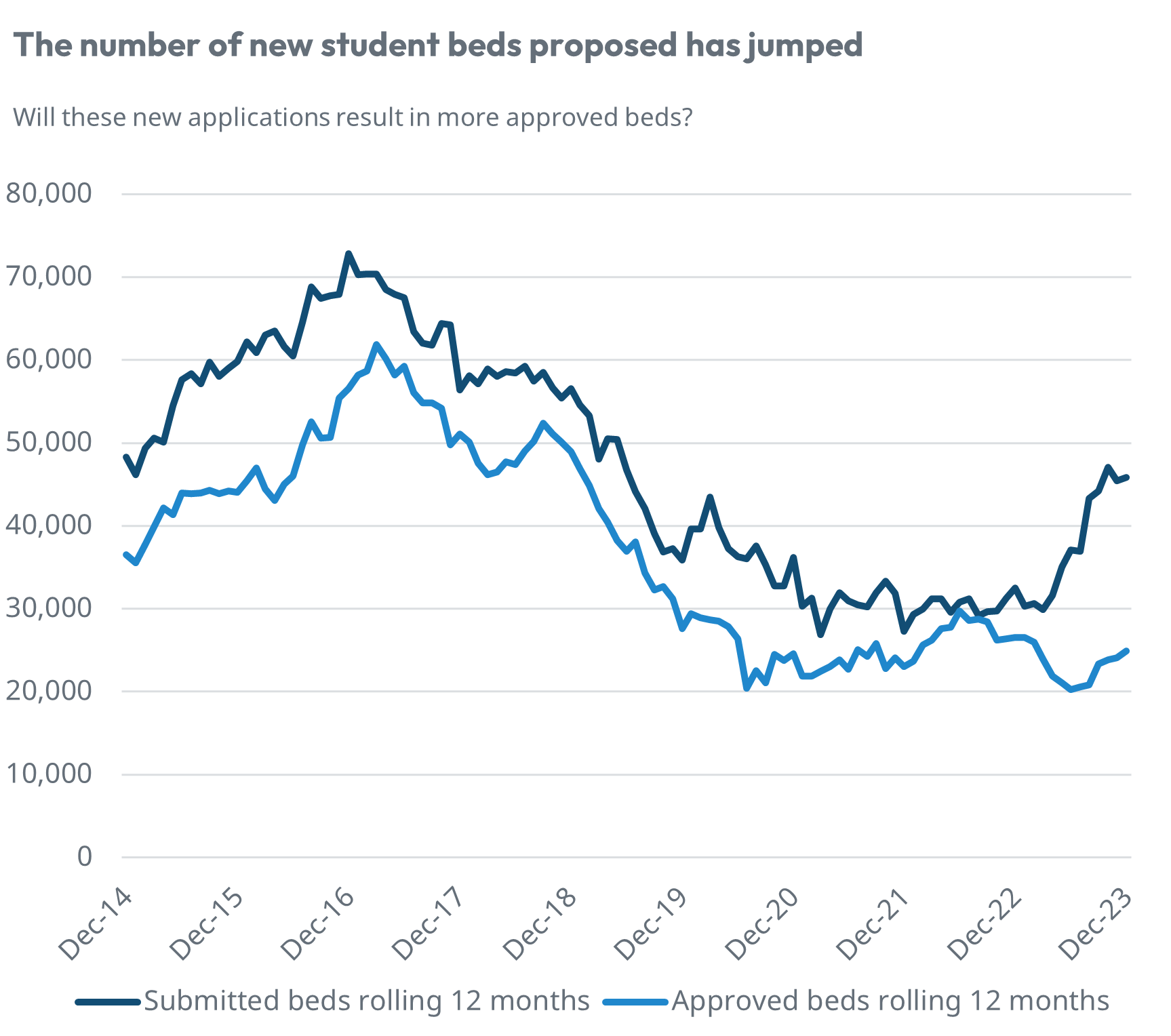

The chart shows submitted and approved planning applications for student accommodation as a 12-month rolling total of student beds, for the whole of the UK.

Planning activity has increased in the most recent quarter. Over 11,000 beds were submitted between October and December and over 6,000 beds were approved. In terms of applications, this is 17% higher than the previous year, and approvals are up 33% YOY.

Planning Activity

Source: StuRents Limited, relevant councils

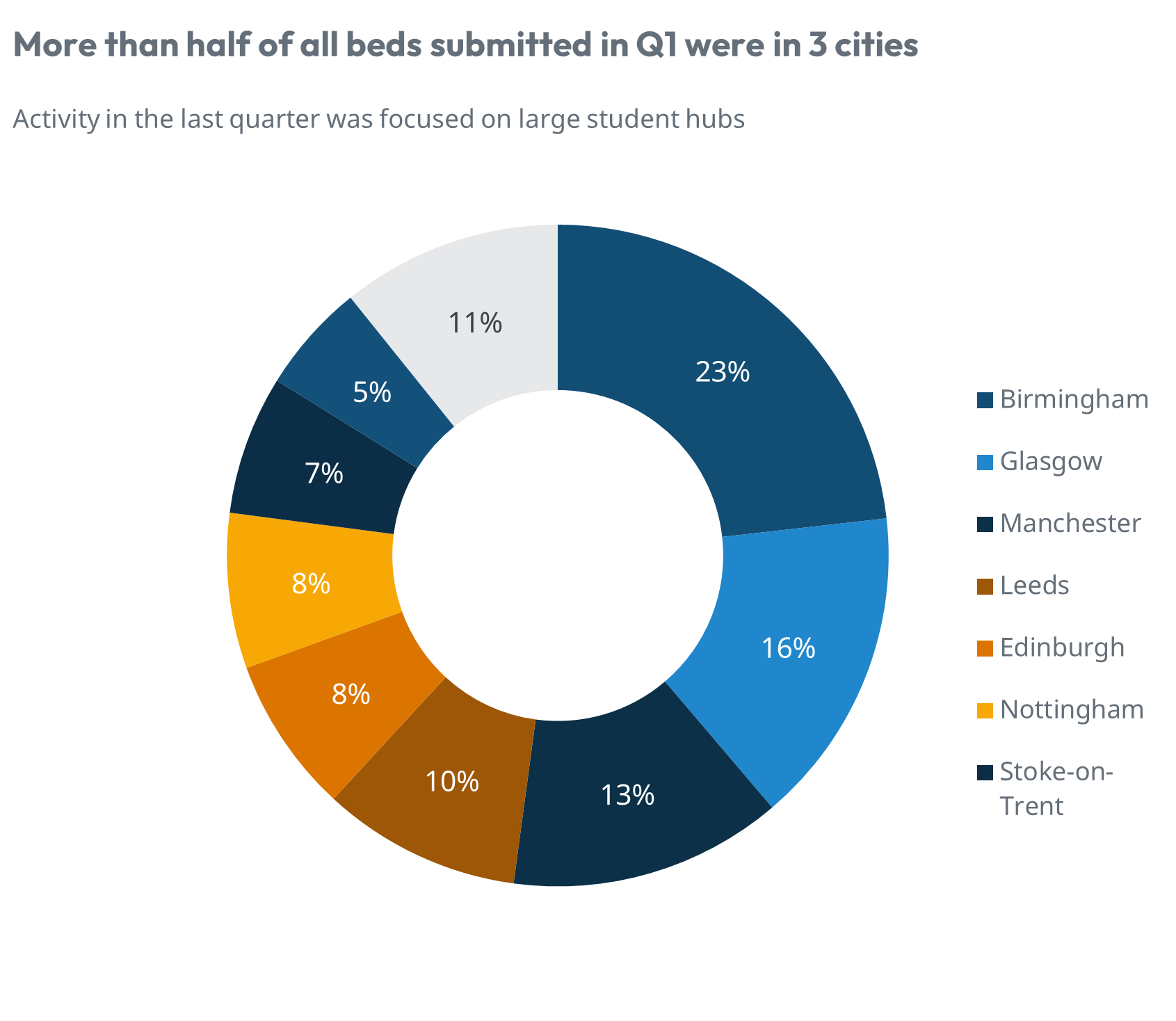

The chart shows the locations that planning applications related to in Q1-2024, and the proportion of total student beds applied for in each city.

More than half of the student beds submitted were related to just three cities: Birmingham, Glasgow, and Manchester.

It is hoped that this planning activity will help to address the well reported shortages, particularly in Glasgow and Manchester. However, it must be noted that not all of these applications will come to fruition.

Pipeline makeup

Source: StuRents Limited, relevant councils

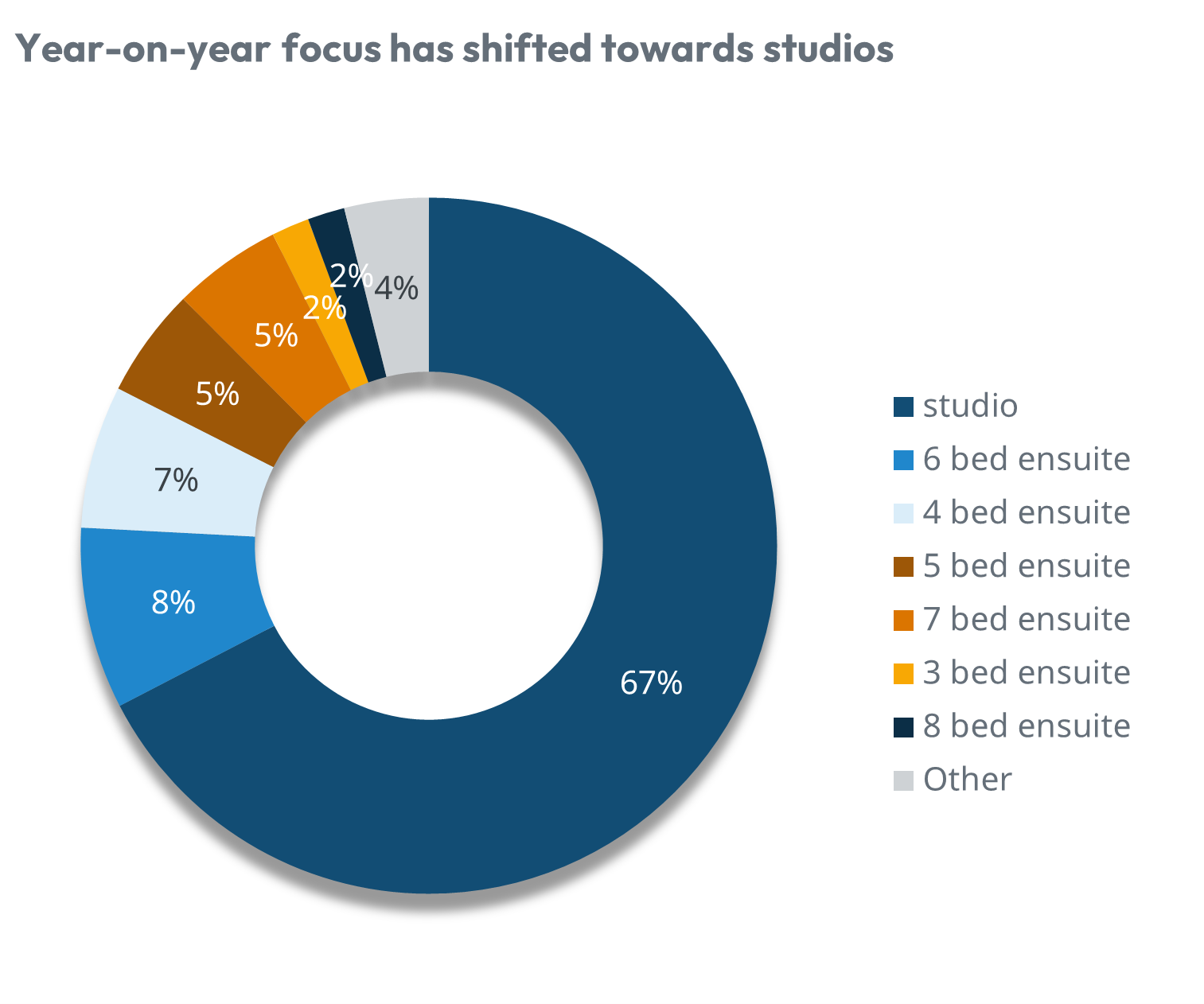

The chart shows the proportion of planning applications made for each bed size in Q1-2024.

More than two-thirds of the applications made in the last quarter were for studios. This is up from just over half of the applications made in the same period one year prior.

This is likely a result of rising construction costs and high-interest rates. The higher rent that studios can achieve will be attractive to investors. However, these beds will be highly reliant on the international market.

Supply Growth

Source: StuRents Limited, relevant councils

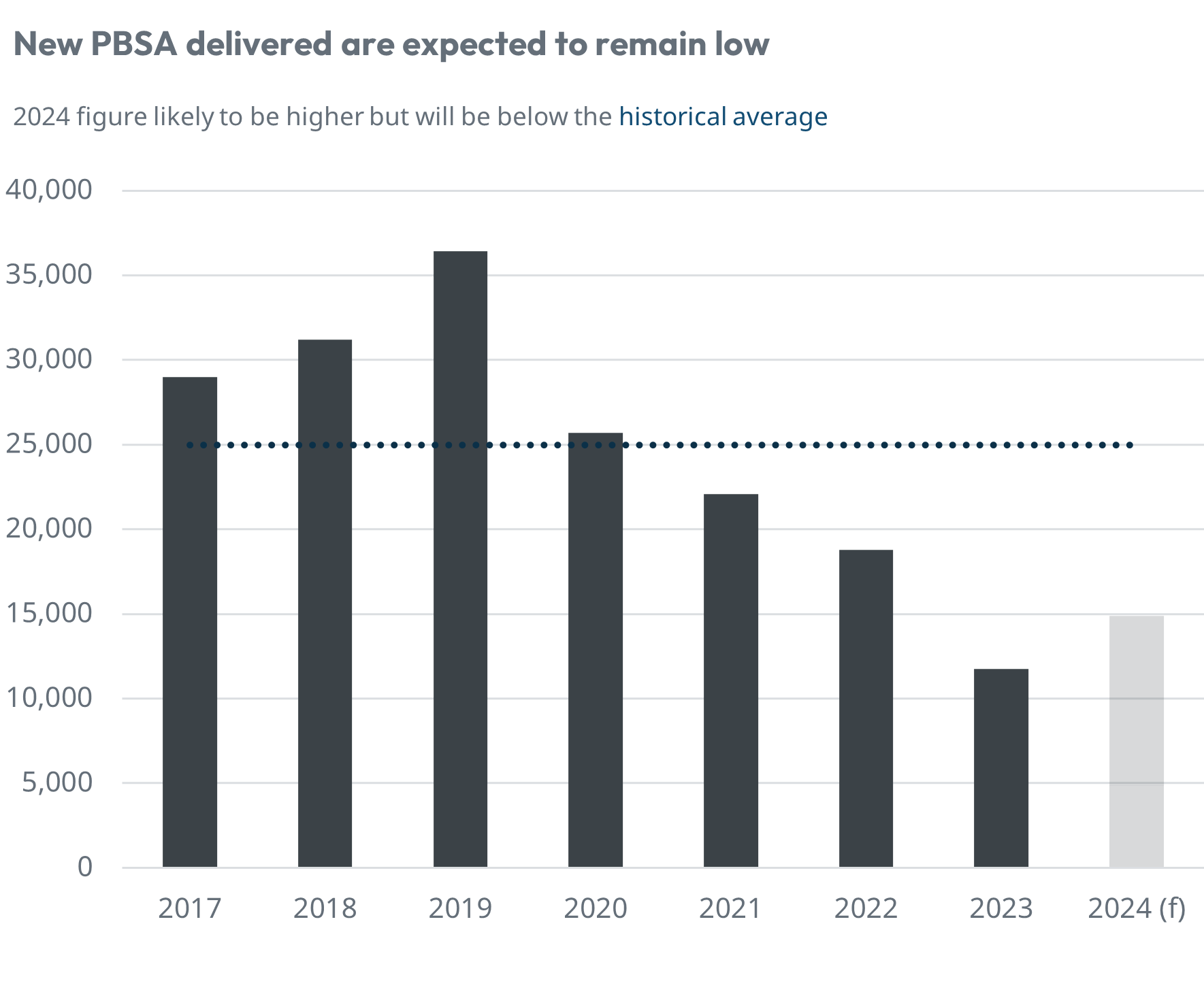

The chart shows the yearly total PBSA beds that have been added to the student housing supply. The chart includes a forecasted figure for 2024, however, this is likely to change as construction work continues.

The average number of beds added to the national supply is 25,000 since 2017.

Delivery has been below the average in recent years and is expected to remain low on a national level.

StuRents' Quarters

Recently our Head of Research, Richard Ward, was joined by Brodie Berman, Senior Acquisitions Associate at Fusion Group, and TONG Partner & Client Services Director, Gabriel Nicklin. The three discuss key trends in the student accommodation sector. Based on research from our quarterly reports and our unique, proprietary data, they explore:

- Demand growth per demographic, as revealed by this year's end-of-cycle statistics from UCAS. Read more.

- Changing student search behaviour and the price points students have been considering. Read more.

- Updates to market supply and the supply pipeline, as described above.

- Booking velocity across key market locations. Read more.

We also asked our audience for their thoughts on some interesting market developments, the results of which can be viewed here.

A recording of the webinar is available to view here.

Share