Student Accommodation Research: Exploring Alternatives to the Student-to-bed Ratio

Student-to-bed Ratio - What are the limitations?

In the UK student accommodation market, the student-to-bed ratio is a frequently used metric, defining the balance between enrolled students and available PBSA beds. This ratio holds significance for both students searching for accommodation and investors or developers within the student housing sector.

Variations in the student-to-bed ratio are substantial, contingent upon factors like the location of the university in a city or town, the institution's popularity among students, and the accessibility of alternative housing options.

A high student-to-bed ratio signifies heightened demand for student housing compared to the available supply. This can lead to better occupancy rates and higher rents for property owners. Conversely, a low student-to-bed ratio suggests an oversupply of student housing relative to demand, potentially resulting in lower occupancy rates and reduced rental income.

Investors and developers meticulously track the student-to-bed ratio to assess market conditions and make informed decisions regarding investments in new student accommodation projects or the management of existing properties. Institutions and student accommodation providers also factor this ratio into their planning for expansions or renovations to ensure they adequately meet the housing needs of enrolled students.

However, it's essential to acknowledge the limitations of this metric. Firstly, the student-to-bed ratio solely focuses on purpose-built student accommodation (PBSA) and disregards housing options provided by houses in multiple occupation (HMOs). HMOs constitute a significant proportion of supply in many towns and cities, and overlooking this segment can lead to an incomplete understanding of the overall supply-demand dynamics.

Secondly, the student-to-bed ratio assumes uniform access and affordability to private PBSA accommodation for all students. This assumption neglects the financial constraints faced by many students, particularly domestic students, who may find purpose-built student accommodation relatively unaffordable.

Building on these considerations, the StuRents research team has analysed several alternative scenarios to dive into this metric further.

Scenario 1 - Core Demand

The first scenario we consider relates to core demand. Core demand is essentially a streamlined view of demand that only takes into account demand from 1st-year undergraduates, as well as 2nd and 3rd-year undergraduate international students and international postgraduates. By excluding domestic demand from non-first-year students, we aim to factor in PBSA demand while assuming a significant proportion of returning domestic students will be considering the HMO market.

When calculating this demand we have considered the number of students that live at home and therefore do not require accommodation. For universities that have multiple campuses, we have discounted the figures again, if there is a campus outside of the headline location.

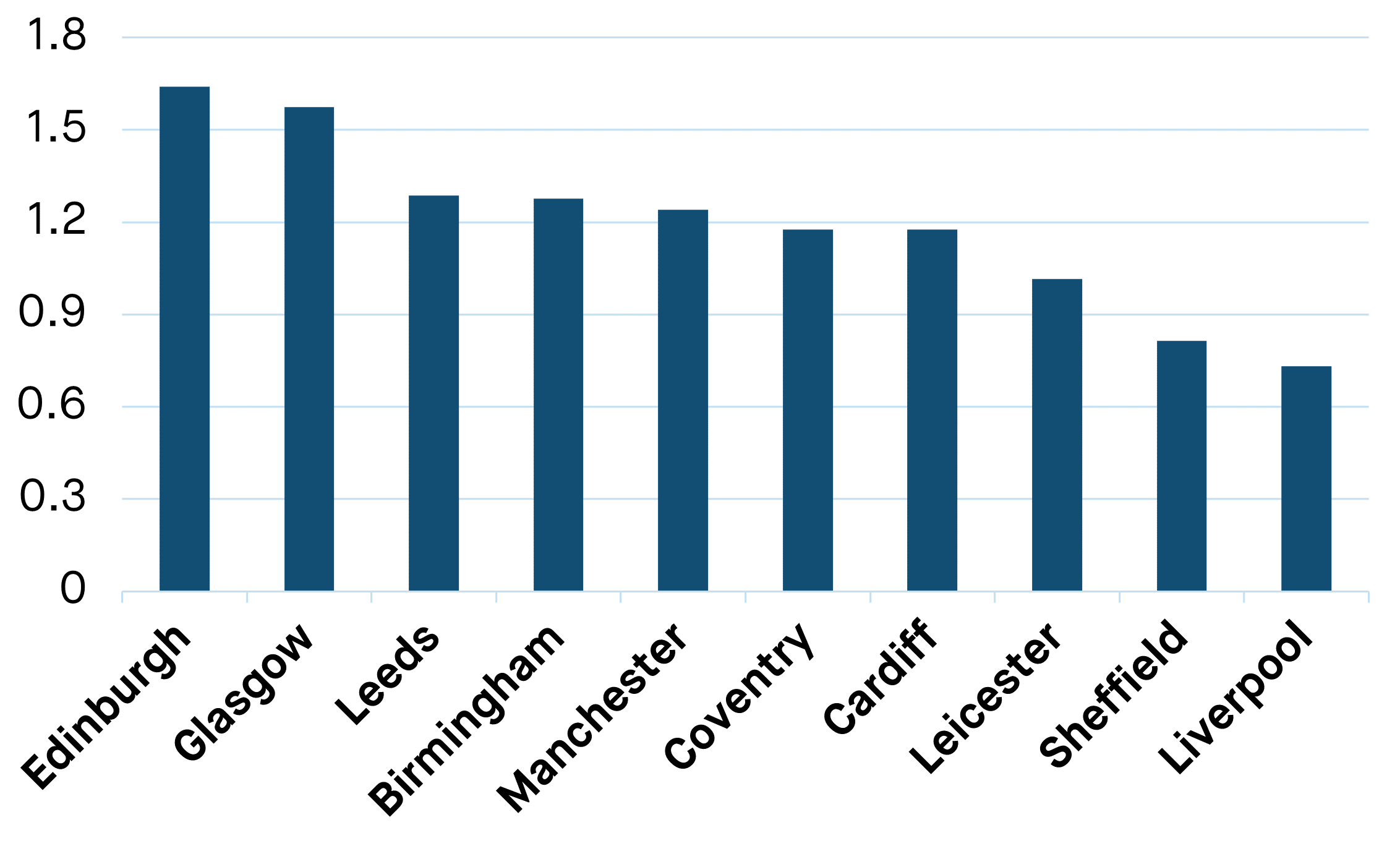

Figure 1 highlights this alternative metric for several key markets in the UK. Edinburgh and Glasgow possess high core student-to-bed ratios at 1.64 and 1.57 respectively, which is unsurprising given the limited supply and strong growth in these cities in recent years. On the other end of the chart, the core demand ratio for student accommodation in Sheffield reached 0.81 in 2021. This is to be expected given operators' recent struggles to fill PBSA beds in the city.

Whilst this metric gives us a closer understanding of market fundamentals, it still fails to factor in the price sensitivity of different demographics.

Figure 1 - Core Demand Student-to-bed Ratio (2021)

Source: StuRents

Scenario 2 - International-only Demand

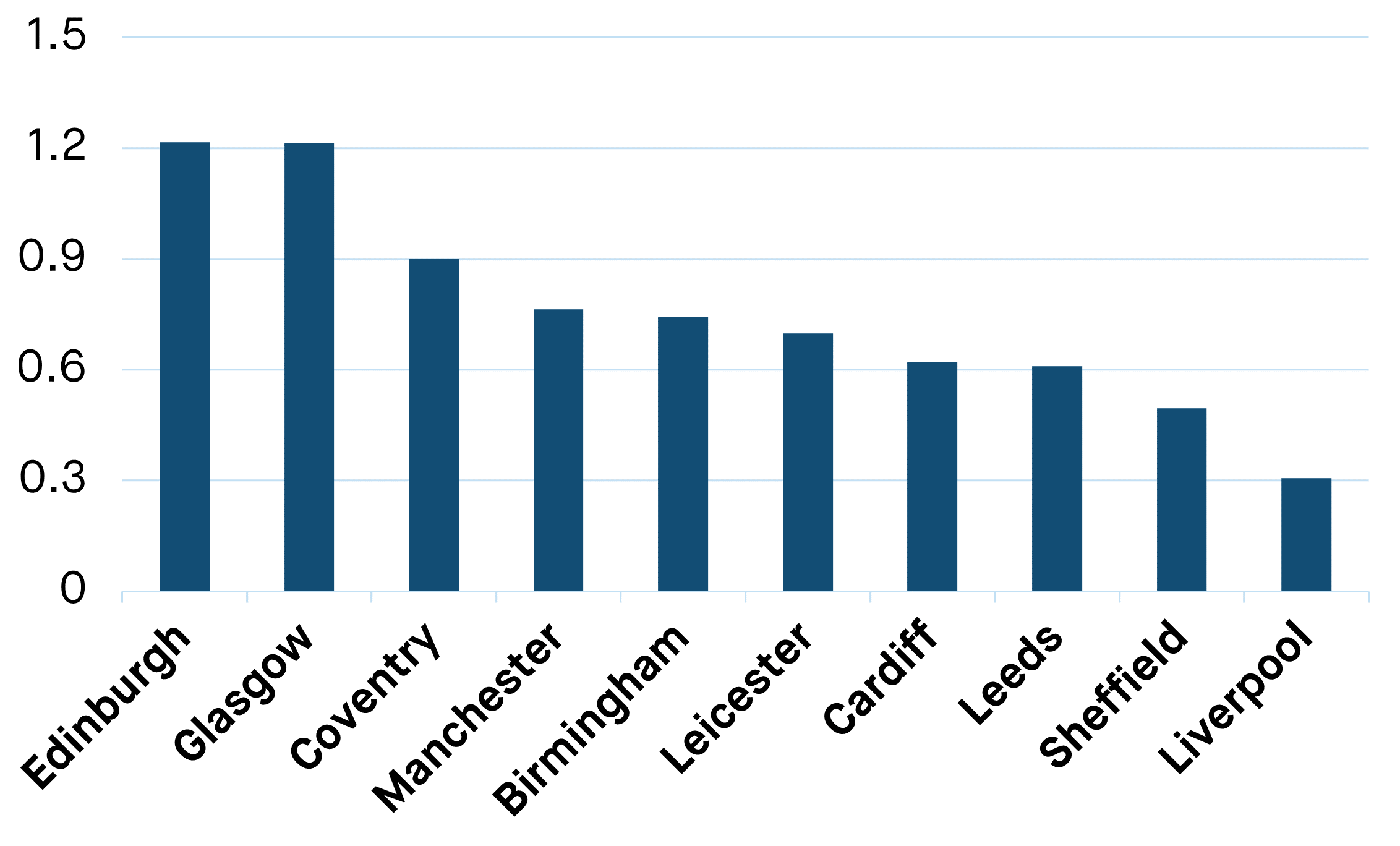

With domestic affordability and the HMO market in mind, the next scenario analysed takes into account international students only. By excluding the domestic market entirely, this international-only student-to-bed ratio offers a fresh insight into the conventional metric, providing a more detailed examination of international demand at a city level.

Whilst this may be a smaller demand pool than reality, the comparison between the two helps to mitigate the shortfalls of the traditional student-to-bed ratio.

Looking at Figure 2, the international ratio for Liverpool was just 0.31 in 2021, meaning that for every international student, there were 3.3 PBSA beds. On the other side, we can see that the fundamentals in both Glasgow and Edinburgh are still hugely positive at 1.21. This means that even if we assume no domestic student wants to live in PBSA, there are still not enough PBSA beds for all internationals in each city.

Figure 2 - International-only Student-to-bed Ratio (2021)

Source: StuRents

Scenario 3 - Chinese Demand

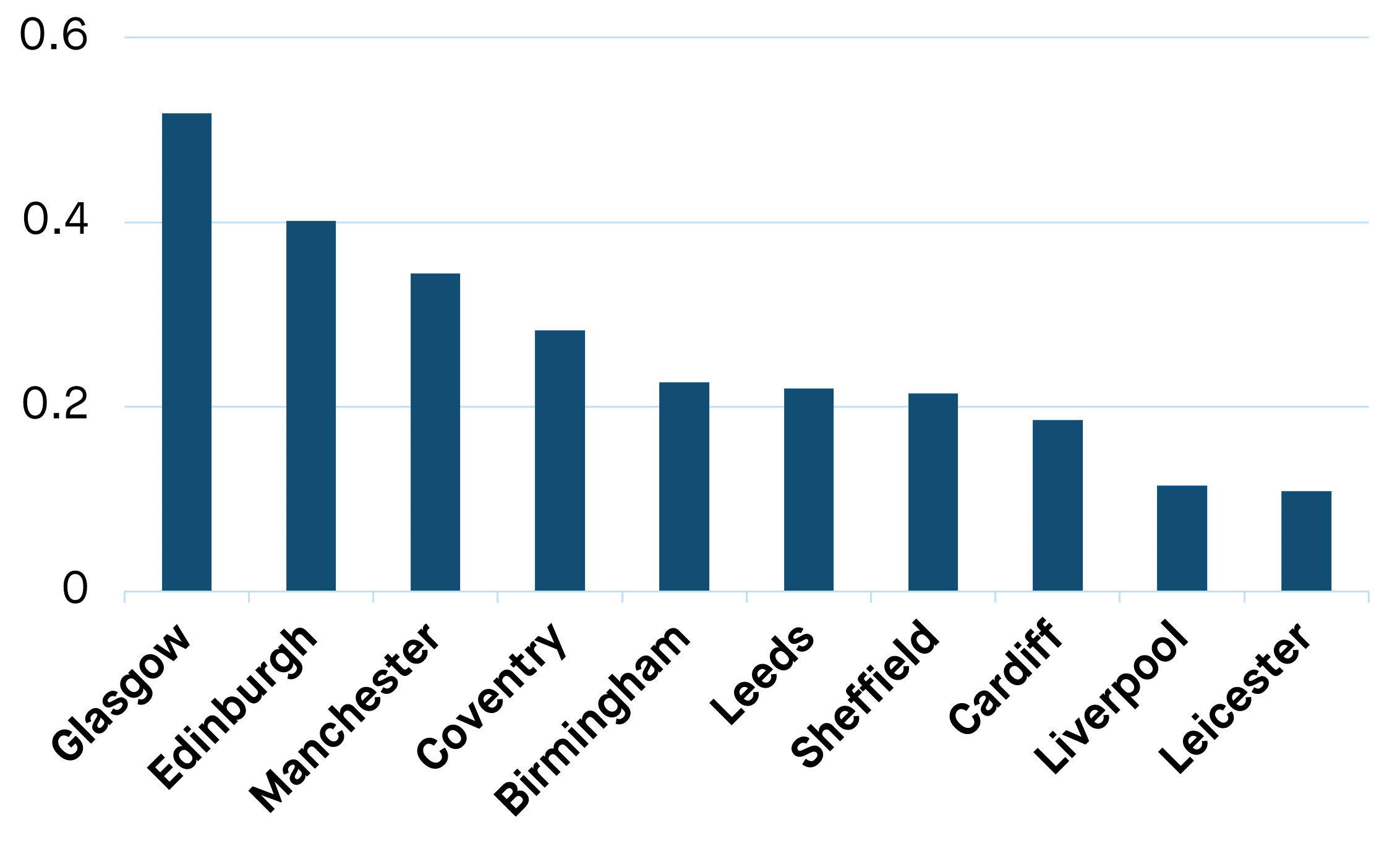

Lastly, it's important to recognise that not every demographic shares the same preferences for accommodation type or budget constraints. Data collected on the StuRents website clearly indicates that Chinese students, on average, have a higher search budget for PBSA beds compared to all other international markets.

Looking at a student-to-bed ratio for Chinese students only gives us another useful indication of the current market dynamics at a city level. In Glasgow, students from China could fill over half of all PBSA beds in the city (including university-managed stock). This is an extremely strong indicator of the potential need for more PBSA stock in the city. This has been reflected in recent news stories in the city, with many students struggling to find suitable accommodation.

Taking Leicester as an opposing example, the Chinese student-to-bed ratio stood at just 0.11 in 2021. By comparison, if we only took into consideration the core ratio (1.02) it would appear to be a positive market. However, given the lower proportion of Chinese students, sensitivity over the pricing of PBSA rooms, as well as unit mix size for new developments should be taken into consideration as it is likely that rooms will need to remain attractive for the domestic market.

Figure 3 - Chinese Student-to-bed Ratio (2021)

Source: StuRents

To conclude, the student-to-bed ratio remains a vital metric in the UK student accommodation market. However, it's clear from the explored alternative scenarios that its limitations highlight the need for additional metrics. Operators, developers, and investors should recognise the diverse preferences and financial constraints among student demographics and factor in variables such as international demand, core demand, and other housing options like HMOs. By adopting a more comprehensive approach to market analysis, stakeholders can gain a deeper understanding of supply-demand dynamics and make more informed decisions regarding investment, development, and management strategies within the student housing sector.

Share