StuRents Q4-2023: Unveiling Key Trends in Student Accommodation

StuRents Q4-2023 Quarterly Reports out now

Every quarter, StuRents produces quarterly reports for 46 university cities and towns across the UK, as well as a national report covering the whole of the UK. With over 750,000 beds listed on our platform each year, we extract millions of data points and analyse these in-depth to develop insights and to understand trends for each university city. This makes our data unique, extensive, and hyper-relevant on a city-by-city basis.

Key findings

PBSA vs. HMO:

- PBSA priced 49% higher than HMOs nationally in Q4-2023, sparking intrigue into the evolving student accommodation market.

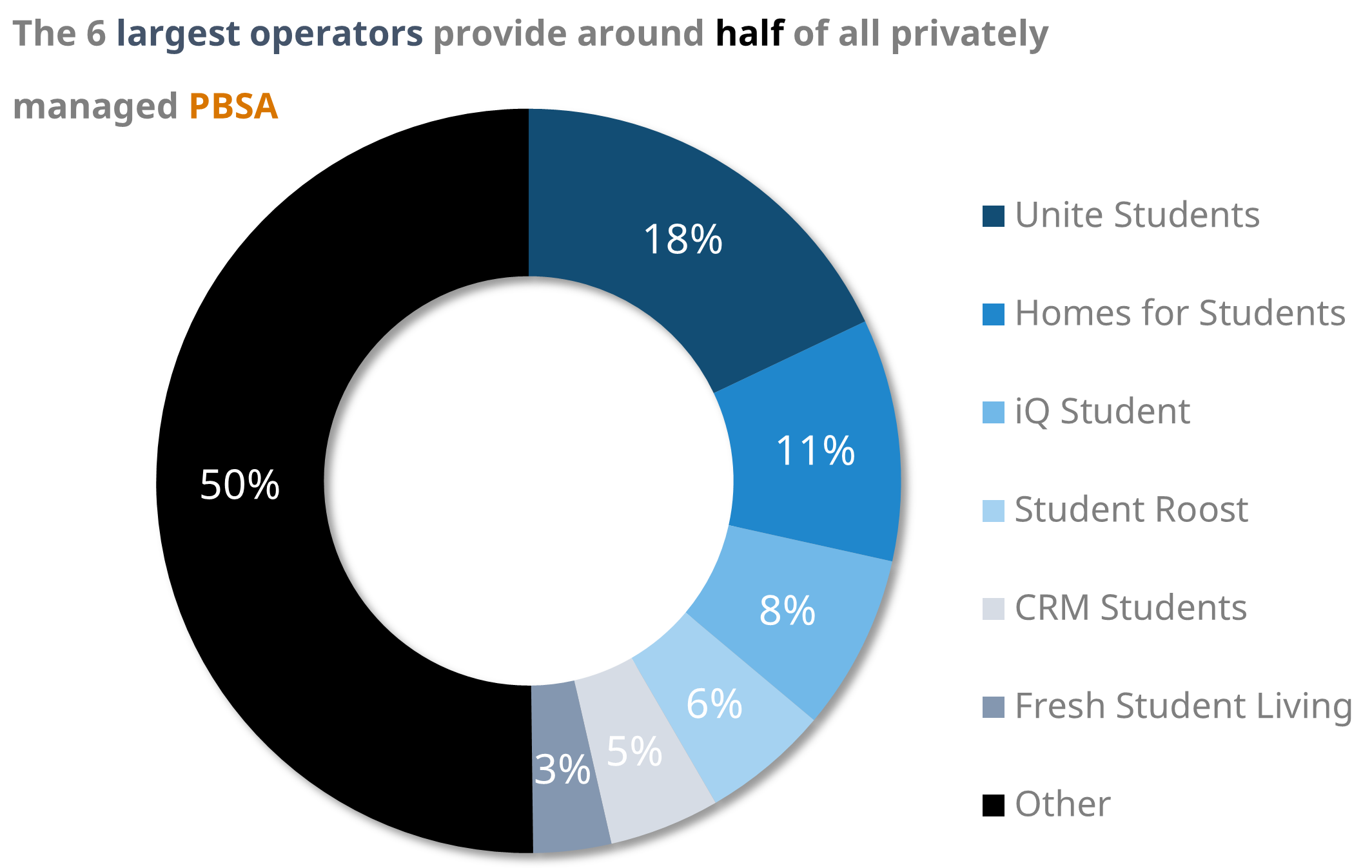

Top Operators:

- Six operators dominate 50% of PBSA beds, spotlighting the industry's landscape and key players.

Demand Surge:

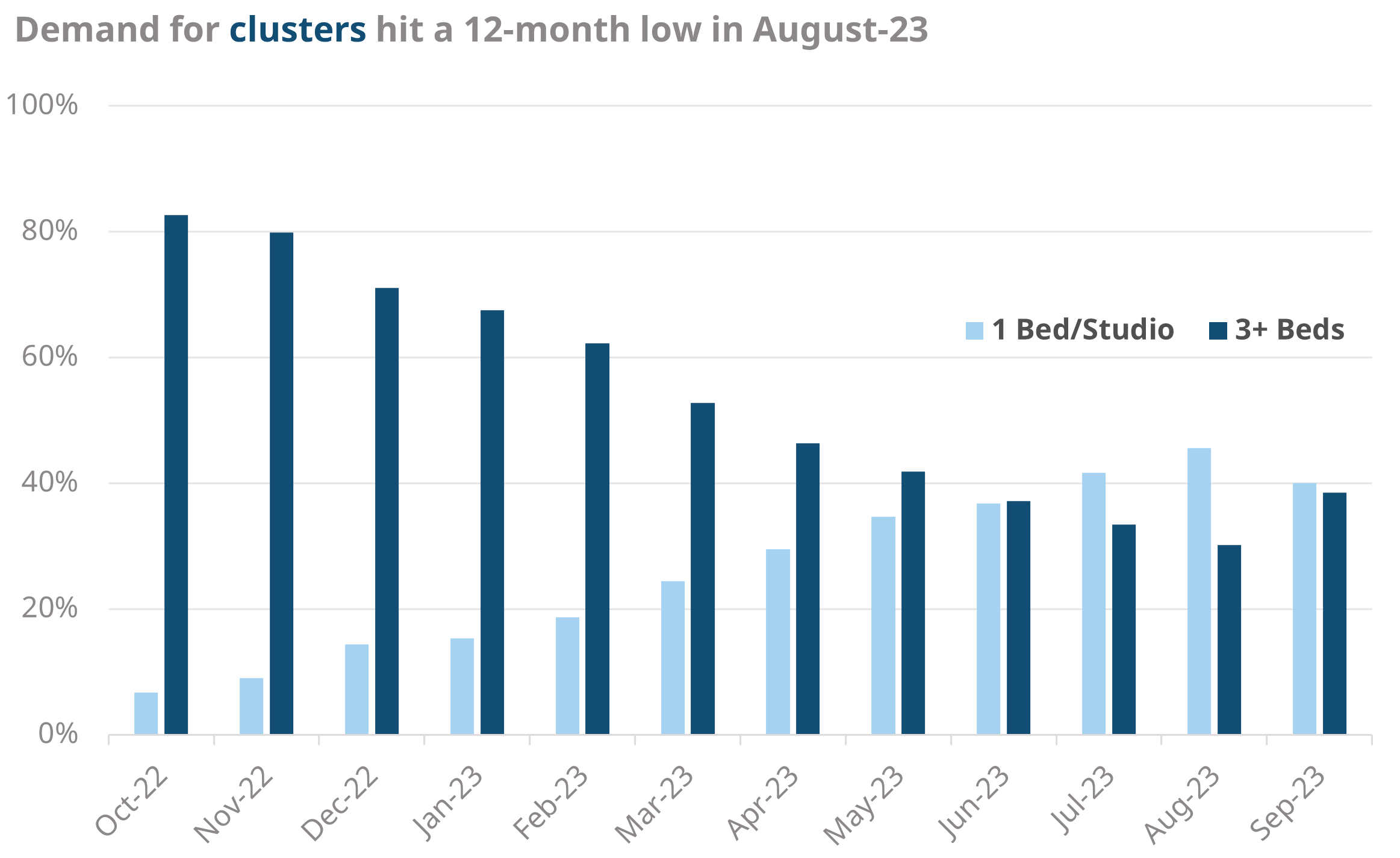

- Demand for 1-bed flats peaked at a 12-month high in August, at the expense of the generally more popular cluster sizes.

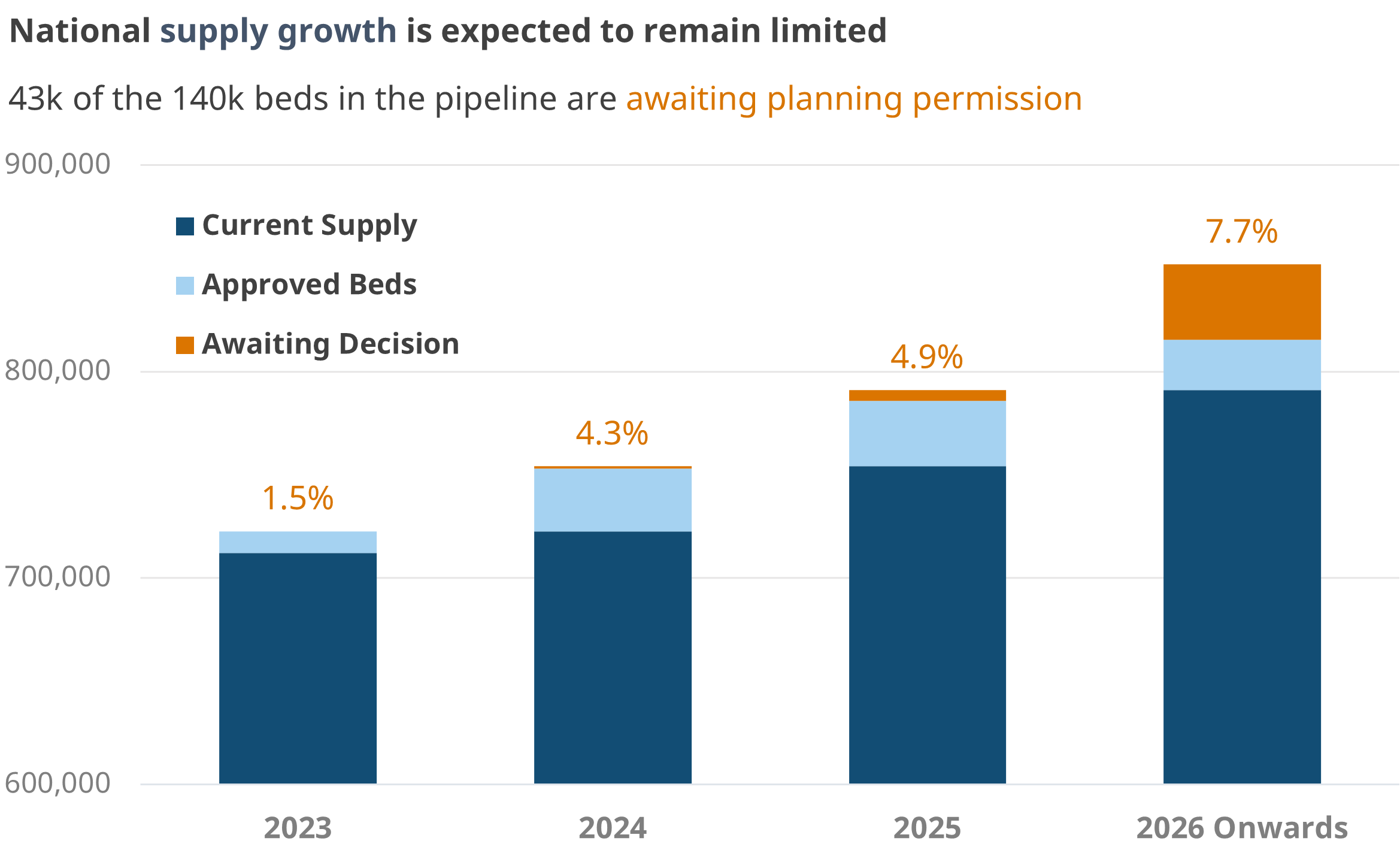

Supply Outlook:

- National PBSA growth forecasts hint at restrained expansion, provoking curiosity about future market dynamics.

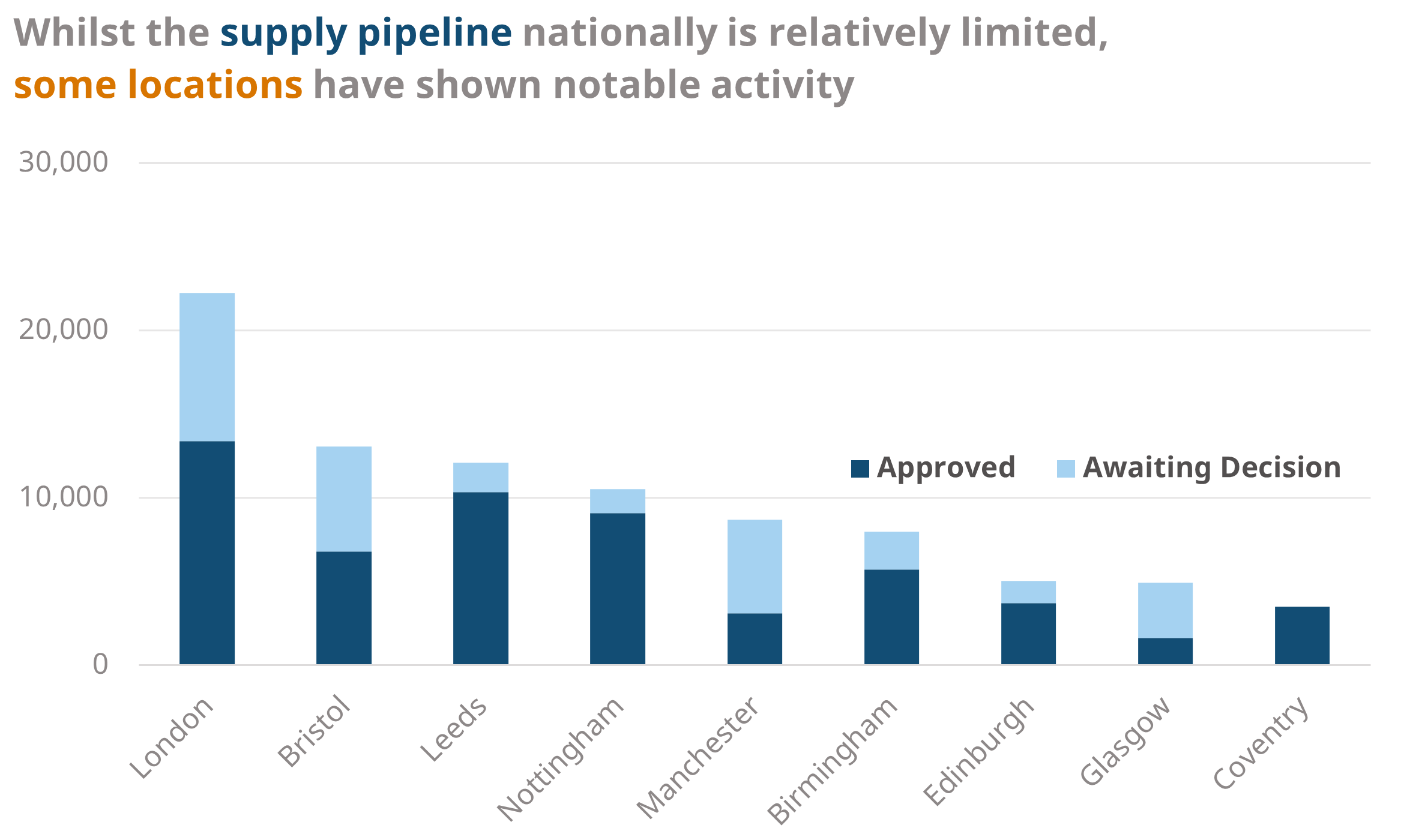

Planning Dynamics:

- Varied planning activity across regions hints at unique developments, shaping local student housing markets.

City Pipeline Surges:

- Bristol poised for a staggering 73% PBSA market surge, spotlighting emerging trends in key cities.

Market Overview

Source: StuRents Limited

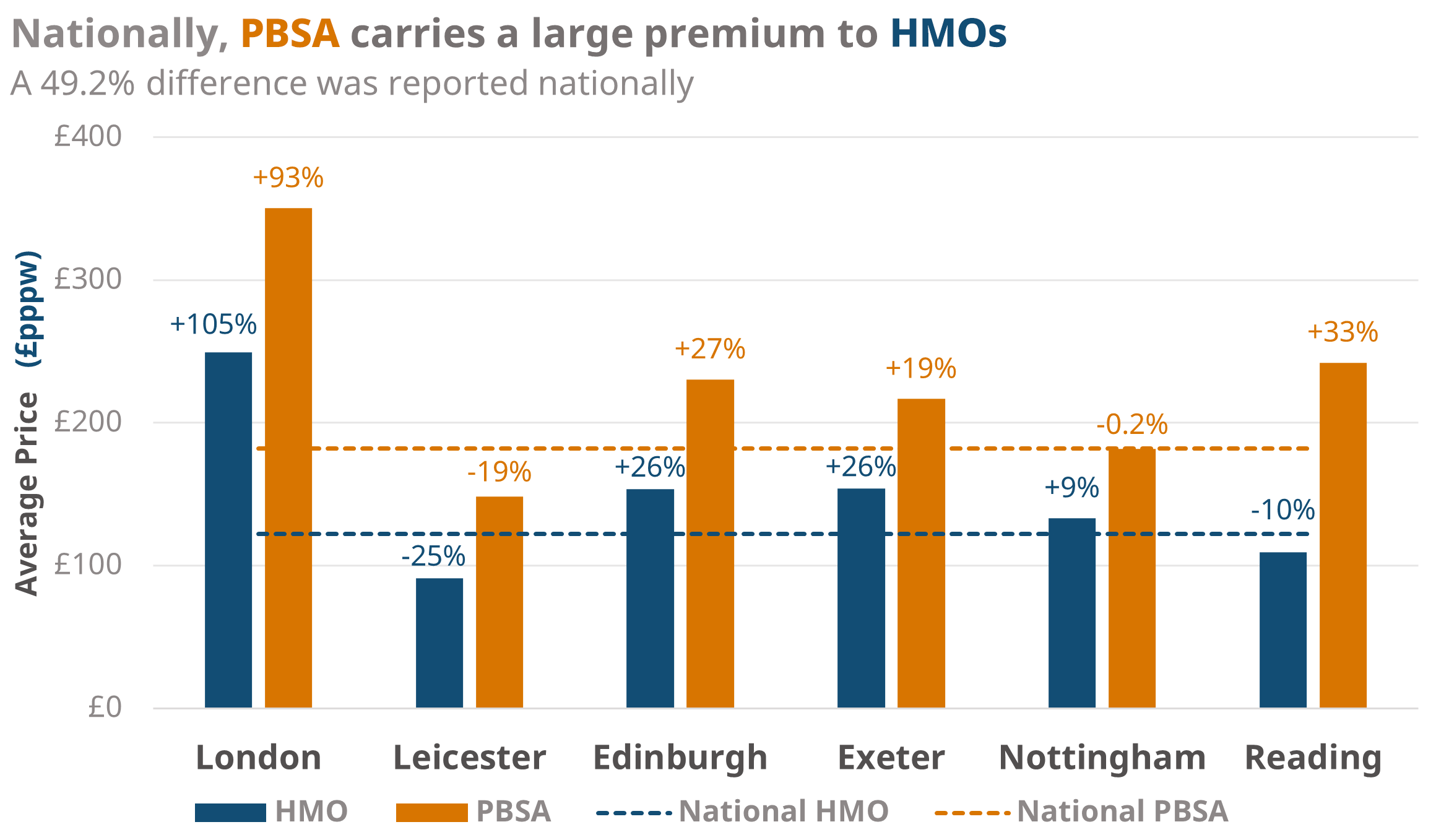

This chart provides a snapshot of headline rental rates in select cities (bars) for both Houses in Multiple Occupation (HMO) and Purpose-Built Student Accommodation (PBSA). While the bars show data for specific locations of interest, the lines represent the headline national level (excluding London), allowing a clearer assessment of how these selected cities deviate from the broader trends.

Nationally, headline average PBSA prices were 49% higher than HMO prices. Outside of London, the average cost of HMOs is £122pppw, compared to £182pppw for PBSA. This gap varies significantly by location.

The data shown here shows that while national averages offer a broad overview, each city has unique dynamics, which influence rental trends and investment landscapes. Each city's unique rental landscape, whether above, below, or in line with the national averages, underscores the importance of tailored analyses when considering student accommodation investments or operations.

Source: StuRents Limited

This chart shows the national market distribution across key operators within the private Purpose-Built Student Accommodation (PBSA) sector. Notably, the data highlights that the six largest operators collectively manage half of all beds in the market. Leading this landscape is Unite Students, holding the largest market share at 18% of all private PBSA beds.

Search Behaviour

Source: StuRents Limited

This chart tracks the search share for both 1-bed flats/studios and larger clusters (with three or more beds) over the past year. Notably, in the last quarter, demand for 1-bed flats and studios surged to a 12-month peak, reaching 46% in August, yet gradually declined to 40% by December. Meanwhile, demand for larger clusters experienced a slight decrease from 33% in July to 30% in August.

Past trends indicate an anticipated surge in demand for larger clusters at the beginning of the upcoming quarter, often at the expense of smaller unit sizes.

Market Supply

Source: StuRents Limited, All relevant councils

Assessing the chart, it's evident that national PBSA supply is projected to rise incrementally in the forthcoming years. Anticipated growth for this year is modest, potentially adding fewer than 13,000 beds, equating to a 1.5% increase.

Projections indicate a potential acceleration in growth by 2024, with an estimated year-on-year expansion of 4.3%, although not all planned schemes may materialise. Subsequently, 2025 could witness a further increase of up to 4.9%.

Significant growth, potentially reaching 7.7% compared to 2025 levels, might unfold from 2026 onwards, yet a considerable proportion of these developments await final decisions.

Whilst these figures are broadly in line with the previous year, looking back historically, these numbers represent a significant reduction in planning application activity. However, some markets across the country have shown an increase in planning activity.

Source: StuRents Limited, All relevant councils

The cities included in the above chart have the highest number of beds currently in their supply pipelines. Unsurprisingly, London is the city with the highest number of beds due to be delivered. If all beds in the pipeline come to fruition, total PBSA supply in the captial could jump by 24% in the coming years. However, the significant number of beds that could be delivered in Bristol would mean that the PBSA market there would increase by a massive 73%.

Some key planning applications that were put forward this quarter include:

- 1,514 beds on Gloucester Road, Bristol by YTL Developments

- 1,100 beds on Upper Brook Street, Manchester by William Motor Co (Holdings) and Alliance UBS Limited

- 941 beds on the Old Kent Road, London by Regal Barkwest Limited

There were also some large schemes that were granted planning permission in Q4-2023:

- 1,763 beds on Westfield Road, Leeds by Urbanite (Leeds)

- 1,224 beds on Echo Street, Manchester by iQ Student Accommodation

- 935 beds on Giles Lane, Canterbury by UKC And St Edmund's School

The variety in planning activity between locations is another example of the importance of considering each market individually.

Further Insights

StuRents Insights Q4 report unveils critical insights into the evolving landscape of the student accommodation market. For a detailed overview of the national trends discussed here, please contact the Research Team for access to our comprehensive national report.

Additionally, our city-level reports offer invaluable in-depth analyses, providing tailored insights crucial for making informed decisions in specific markets. Understanding city-level nuances is essential for investors and operators navigating the diverse landscape of student accommodation. Reach out to us to explore our city reports and gain a deeper understanding of local market dynamics and identify strategic opportunities.

To get the latest insights into student accommodation research in the UK, become an Insider.

Share