Early signs of a decline in PBSA occupancy

PBSA occupancy falls year-on-year

PBSA occupancy remains a critical insight for industry stakeholders. Whether it is simply used for benchmarking against the market or to help with dynamic pricing strategies, timely and accurate information on occupancy (booking velocity) ensures users can make informed decisions backed up by data.

At StuRents, we have worked in collaboration with the industry to provide our members with such insights.

With the first quarter of the 2024-25 lettings cycle behind us, we have taken stock and looked at how the sector is performing year-on-year, with some interesting variances between locations and booking cycles.

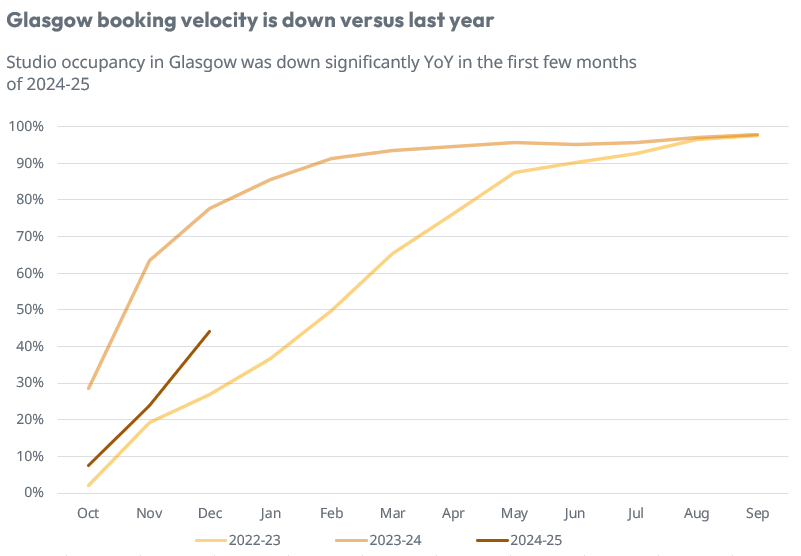

Last year, markets such as Glasgow witnessed significant growth in booking velocity, which in turn led to strong rental growth and a scramble for accommodation. Whilst some of this positivity was tempered later in the year with the emergence of fake bookings and the accreditation scandal, leading to late voids, the speed at which rooms were sold was extremely high.

For example, by the end of December 2022, across participating members, 78% of studios were booked. Fast forward 12 months and the latest data indicates this has dropped to 44%. This represents a significant shift year-on-year, albeit it remains above the position recorded in 2022-23 (27%). A similar trend has been observed for clusters in Glasgow, with 42% booked by the end of 2023, down from 75% the previous year.

Source: StuRents Limited

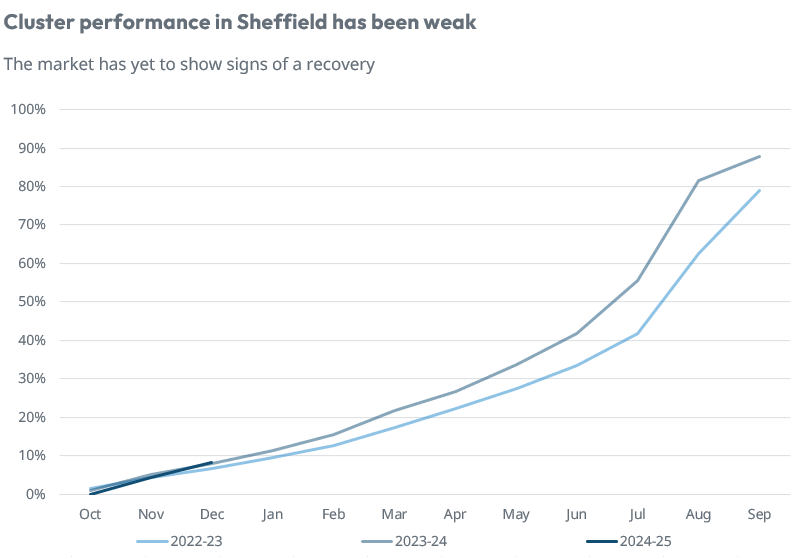

Despite the aforementioned slowdown, Glasgow remains far ahead of some of the more challenging locations.

Examining student accommodation in Sheffield, at the end of 2023, studio and cluster occupancy for the 2024-25 intake stood at just 17% and 8% respectively, highlighting the vast differences in performance between locations.

Source: StuRents Limited

Elsewhere, studios in Exeter and Southampton have also seen year-on-year declines. In the former location, members were reporting studio occupancy of 25% in December (2022: 29%), whilst in Southampton, this stood at 56% (2022: 64%).

One possible reason for the year-on-year reduction in booking velocity in some of the locations mentioned is a more cautious approach from operators. For example, it has been noted that some have increased their deposit requirements to mitigate against a repeat of issues faced last year, specifically around fake bookings. Of course, tighter risk management, such as requesting deposits or proof of ID at the point of booking, can help reduce this risk but must be weighed up against deterring genuine interest.

Other markets have seen some modest improvement. In what could be the early signs of a recovery, studio occupancy in Coventry is up year on year, albeit there has been no improvement in cluster occupancy.

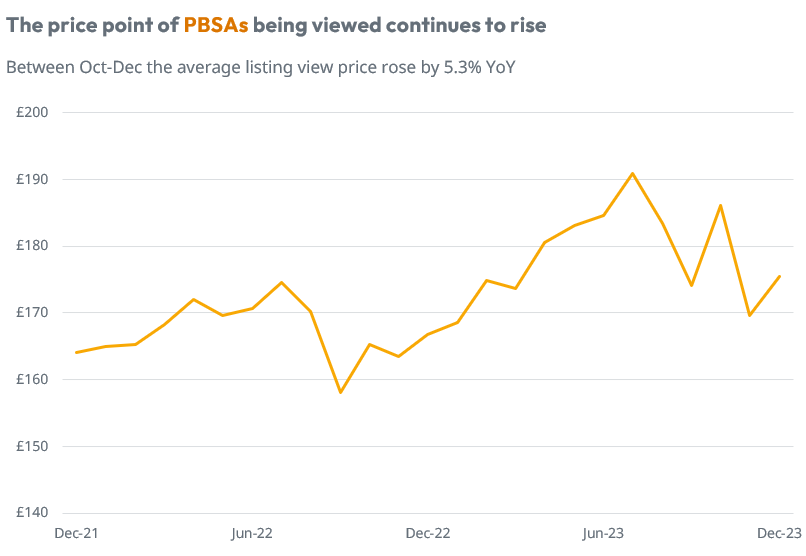

Looking beyond occupancy data, analysis of price demand can be useful to understand the propensity of students to search and book accommodation at various prices and how these are changing over time.

The trend over the last few years is clear, due to rental growth and favourable supply vs demand fundamentals, students are searching for properties at higher price points, at least on a national level outside of London. From the chart below, price seasonality can be deduced - an important consideration to factor into any dynamic pricing strategies. For example, in Jul-23, across all locations (excluding London) and accounting for all demographics, the average PBSA price viewed was £190.92pppw, which represents a 9.2% premium compared to the figure recorded in Feb-23.

Whilst Oct-Dec is still very early in the typical PBSA lettings cycle, for the 2024-25 season, those properties viewed were 5.3% more expensive than those searched for at the same period a year earlier.

Source: StuRents Limited

As always, these trends will vary significantly between locations. However, insights such as these combined with an understanding of local occupancy can be the difference in being able to maximise revenue and ensure assets are fully utilised.

Occupancy insights are now available to members via the StuRents Intelligence Portal.

To take advantage of monthly city-level insights into PBSA occupancy, become a member by contacting occsurvey@sturents.com

Share