Growth in PBSA shows huge variances

The shortage of accommodation at a national level has been well reported. However, growth between locations has varied significantly.

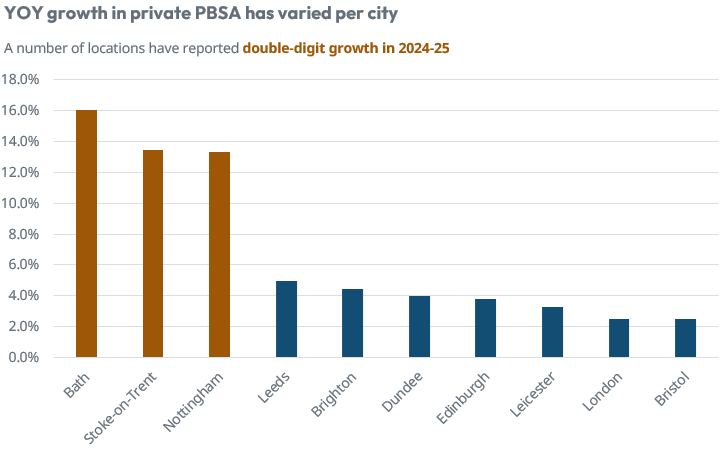

Whilst figures will continue to evolve, several cities, such as Bath and Nottingham have reported growth in the supply of PBSA of more than 10% year-on-year (YOY) for 2024-25.

In comparison, growth nationally is expected to remain well below 2%. Some locations with the largest supply challenges, such as Glasgow, do not appear in the top 10 in terms of growth despite the obvious need for beds. Similarly, changes to supply in London, mean an increase is likely to be short of 3%.

The chart below highlights the significant variation between cities.

Source: StuRents

Taking Nottingham as an example, more than 2k beds have been delivered in time for the 2024-25 cycle. In comparison, whilst growth in Bath is likely to be much lower at <400, the year-on-year change in percentage terms is higher.

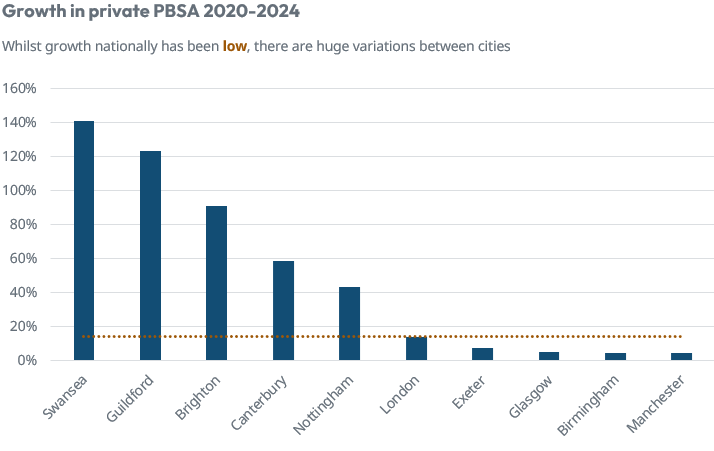

Changes to supply over the long term have also varied. At a national level, growth in PBSA averaged ~3.3% between 2020-2024, equating to around ~12k beds per year. Whilst it's not possible to currently compare this to demand growth over the same period due to the time lag from HESA, if we take the latest data available covering 2017-2021, student numbers grew by an average of 78k p.a. Of course, not all these students will require accommodation but this does highlight the discrepancy between supply and demand growth at a national level.

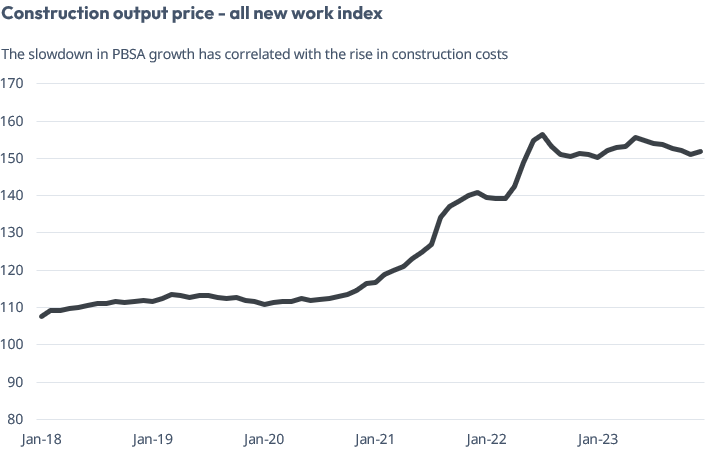

Part of the issue in recent years has been the cost of construction, along with the cost of debt and other influencing factors. Whilst costs have somewhat stabilised, as shown below, they remain elevated compared to historical levels, making it harder to build accommodation at viable or affordable levels.

Source: Gov.uk

Despite this, some locations have seen significant growth, albeit from a low base. For example, Swansea has seen bed numbers jump by more than 140% since 2020. Likewise, in Guildford, PBSA has grown by more than 120%. At the other end of the scale, Glasgow, Birmingham and Manchester have seen numbers increase by around 5% or less, which is likely to be well below the increase in student numbers over the same period.

Source: StuRents

Nationally, if demand continues to grow as it has, bed shortages are likely to be exacerbated. However, as the data highlights, there are huge differences between cities. This means it is crucial that investors understand their local markets in detail. As we have seen historically, markets can quickly become oversupplied and the risk is that in such a hot sector, investors flock to fill the gap, not always with the most suitable product, thereby finding themselves out in the cold in the long run should fundamentals move against them.

To receive regular updates on the student accommodation market sign up to our monthly newsletter at StuRents.com/research

Share